Question: A borrower is faced with choosing between two loans. Loan A is available for $82,000 at 6 percent interest for 30 years, with 6 point

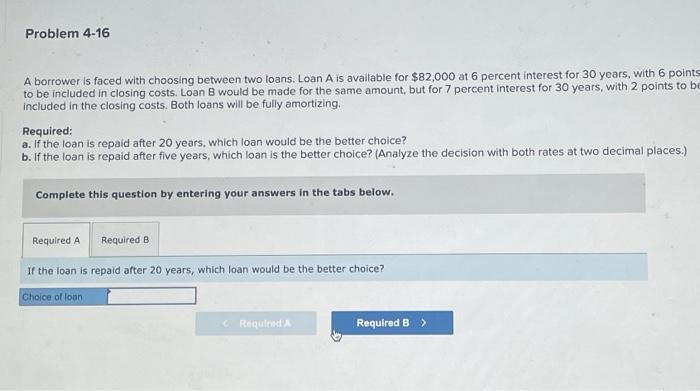

A borrower is faced with choosing between two loans. Loan A is available for $82,000 at 6 percent interest for 30 years, with 6 point to be included in closing costs. Loan B would be made for the same amount, but for 7 percent interest for 30 years, with 2 points to b included in the closing costs. Both loans will be fully amortizing. Required: a. If the loan is repaid after 20 years, which loan would be the better choice? b. If the loan is repaid after five years, which loan is the better choice? (Analyze the decision with both rates at two decimal places.) Complete this question by entering your answers in the tabs below. If the loan is repaid after 20 years, which loan would be the better choice? If the loan is repaid after five years, which loan is the better choice? (Analyze the decision with both rates at two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts