Question: A borrower is purchasing a property and can choose between two possible loan alternatives. The first is a 85% LTV for 25 years at 9%

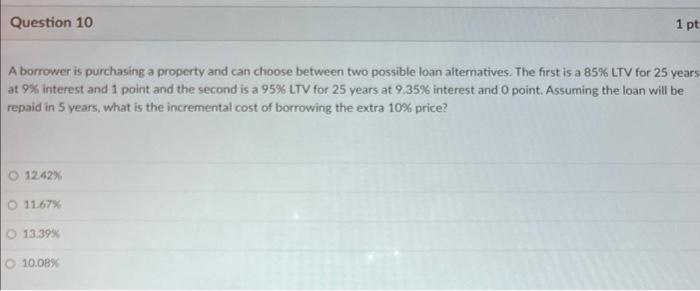

A borrower is purchasing a property and can choose between two possible loan alternatives. The first is a 85% LTV for 25 years at 9% interest and 1 point and the second is a 95% LTV for 25 years at 9.35% interest and 0 point. Assuming the loan will be repaid in 5 years, what is the incremental cost of borrowing the extra 10% price? 1242% 11.67% 13.39% 10.08% A borrower is purchasing a property and can choose between two possible loan alternatives. The first is a 85% LTV for 25 years at 9% interest and 1 point and the second is a 95% LTV for 25 years at 9.35% interest and 0 point. Assuming the loan will be repaid in 5 years, what is the incremental cost of borrowing the extra 10% price? 1242% 11.67% 13.39% 10.08%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts