Question: A brief explaination of each correct answer would be sufficient. Appreciate your help in advance & I'll be sure to leave a thumb up! 1.

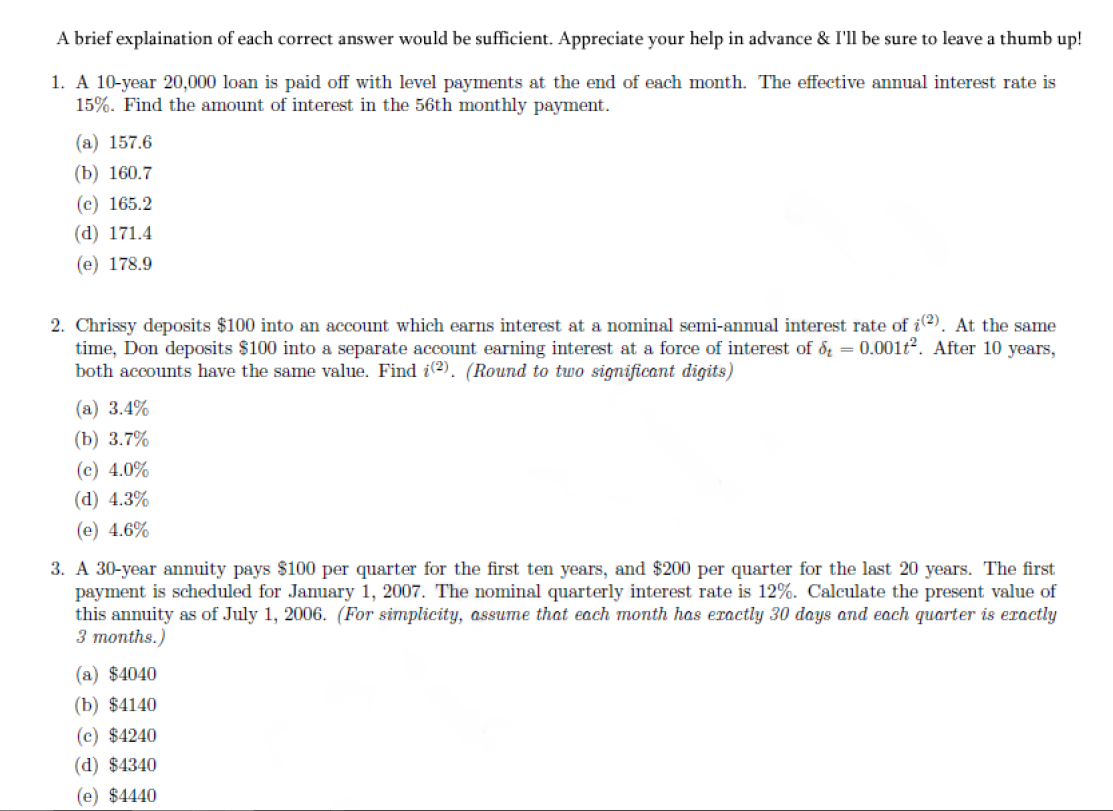

A brief explaination of each correct answer would be sufficient. Appreciate your help in advance & I'll be sure to leave a thumb up! 1. A 10-year 20,000 loan is paid off with level payments at the end of each month. The effective annual interest rate is 15%. Find the amount of interest in the 56th monthly payment. (a) 157.6 (b) 160.7 (c) 165.2 (d) 171.4 (e) 178.9 2. Chrissy deposits $100 into an account which earns interest at a nominal semi-annual interest rate of i(2). At the same time, Don deposits $100 into a separate account earning interest at a force of interest of 8 = 0.001". After 10 years, both accounts have the same value. Find i(2). (Round to two significant digits) (a) 3.4% (b) 3.7% (c) 4.0% (d) 4.3% (e) 4.6% 3. A 30-year annuity pays $100 per quarter for the first ten years, and $200 per quarter for the last 20 years. The first payment is scheduled for January 1, 2007. The nominal quarterly interest rate is 12%. Calculate the present value of this annuity as of July 1, 2006. (For simplicity, assume that each month has eractly 30 days and each quarter is eractly 3 months.) (a) $4040 (b) $4140 (c) $4240 (d) $4340 (e) $4440

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts