Question: a. Briefly explain the analytical tools, which used to determine the desirability of investment proposals. (3 Marks) Click or tap here to enter text. b.

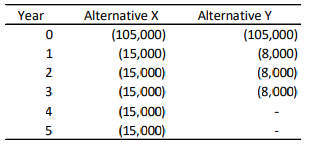

a. Briefly explain the analytical tools, which used to determine the desirability of investment proposals. (3 Marks) Click or tap here to enter text. b. What are the advantages of using the payback period as an investment decision criterion? What are the limitations? (2 Marks) Click or tap here to enter text. c. What is the present value of a $2500 annual perpetuity at the end of each year, discounted back to the present at 9%? (2 Marks) Click or tap here to enter text. d. Explain the differences among the weak-form, semi-strong-form, and strong-form of the market efficiency, using the efficient markets hypothesis? (3 Marks) Click or tap here to enter text. e. You have two alternatives for the replacement of the old machine in your family-owned business. Machine X & Y meet the same efficiency level and perform the same activities but generate different cash flows. The cost is $105,000 for each machine. Machine X has a useful life of 5 years and Y has 3 years useful life. The discount rate is 12%. Using the after-tax costs, calculate NPV for each project and select the best alternative.

Year 1 O Nm Alternative X (105,000) (15,000) (15,000) (15,000) (15,000) (15,000) Alternative Y (105,000) (8,000) (8,000) (8,000) 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts