Question: A broker writes an American call option with strike E = 95 and expiry date T = 3 years. The risk-free interest rate is r

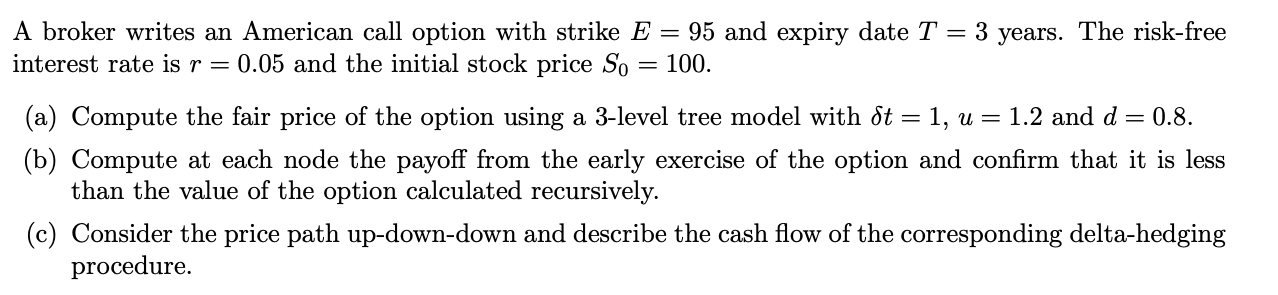

A broker writes an American call option with strike E = 95 and expiry date T = 3 years. The risk-free interest rate is r = 0.05 and the initial stock price So = 100. (a) Compute the fair price of the option using a 3-level tree model with dt = 1, u = 1.2 and d= 0.8. (b) Compute at each node the payoff from the early exercise of the option and confirm that it is less than the value of the option calculated recursively. (c) Consider the price path up-down-down and describe the cash flow of the corresponding delta-hedging procedure. A broker writes an American call option with strike E = 95 and expiry date T = 3 years. The risk-free interest rate is r = 0.05 and the initial stock price So = 100. (a) Compute the fair price of the option using a 3-level tree model with dt = 1, u = 1.2 and d= 0.8. (b) Compute at each node the payoff from the early exercise of the option and confirm that it is less than the value of the option calculated recursively. (c) Consider the price path up-down-down and describe the cash flow of the corresponding delta-hedging procedure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts