Question: (a) Bundoora Ltd commences operations on 1 July 2020. One year after the commencement of its operations(30 June 2021) the entity prepares the following information

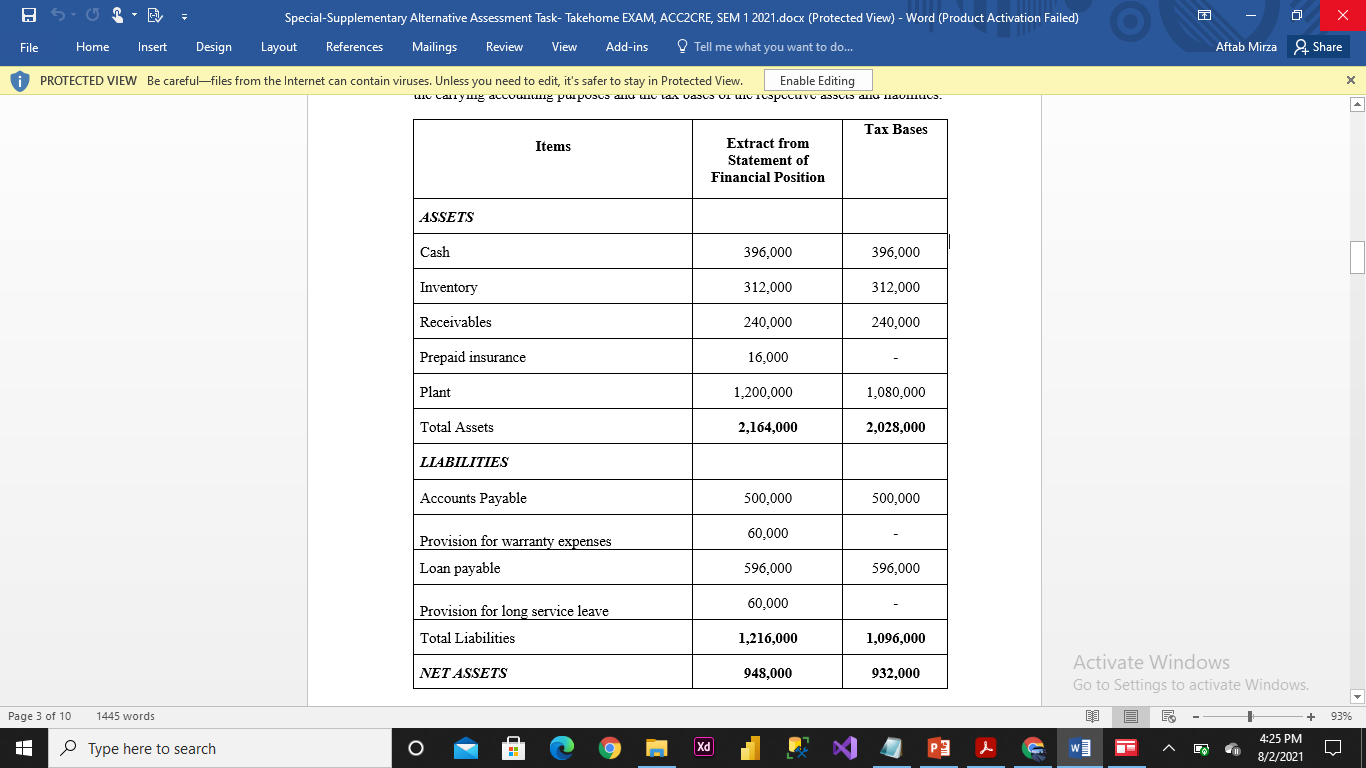

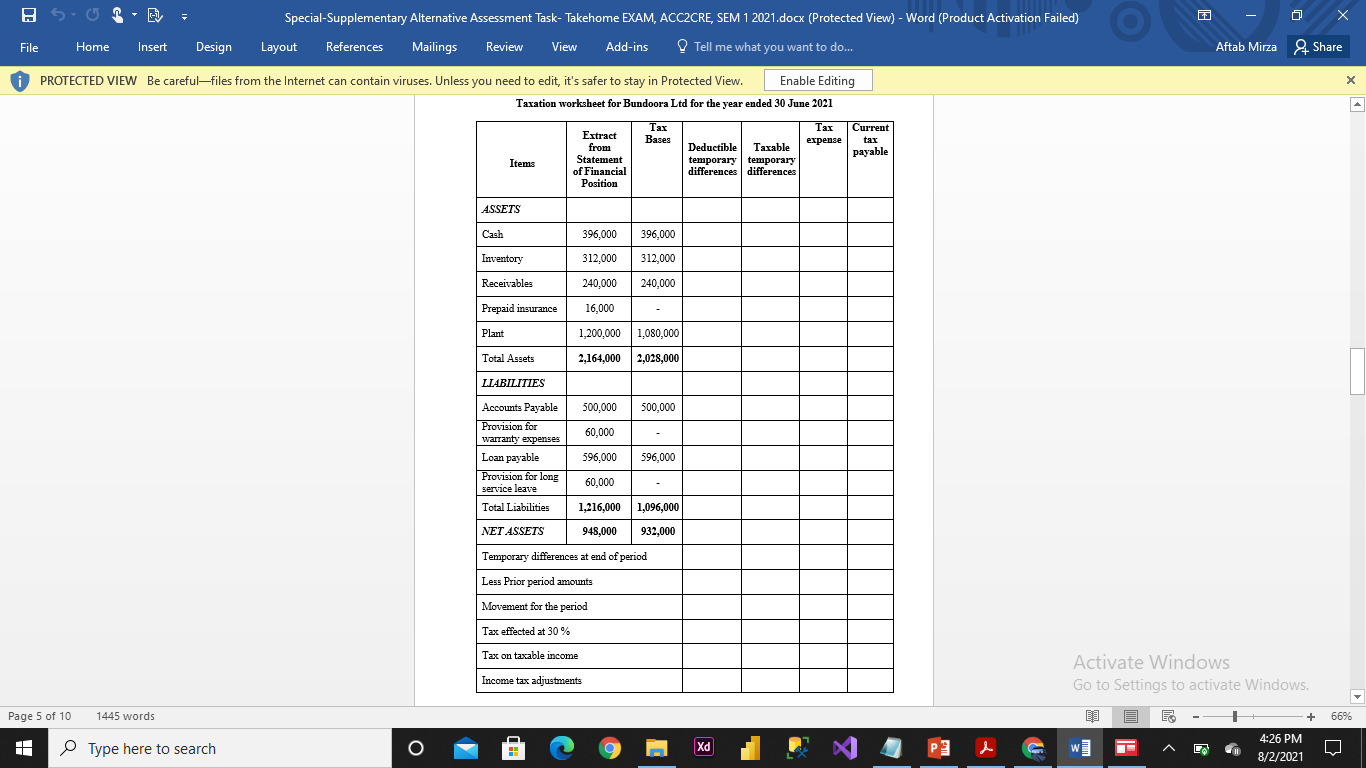

(a) Bundoora Ltd commences operations on 1 July 2020. One year after the commencement of its operations(30 June 2021) the entity prepares the following information showing both the carrying accounting purposes and the tax bases of the respective assets and liabilities.

Special-Supplementary Alternative Assessment Task- Takehome EXAM, ACC2CRE, SEM 12021.docx (Protected View) - Word (Product Activation Failed) X File Home Insert Design Layout References Mailings Review View Add-ins Tell me what you want to do.. Aftab Mirza Share PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing X uly carrying accounting purposes and my toA vases of wid respective assets and navmacs. Tax Bases Items Extract from Statement of Financial Position ASSETS Cash 396,000 396,000 Inventory 312,000 312,000 Receivables 240,000 240,000 Prepaid insurance 16.000 Plant 1.200,000 1,080,000 Total Assets 2,164,000 2,028,000 LIABILITIES Accounts Payable 500,000 500,000 60.000 Provision for warranty expenses Loan payable 596,000 596,000 60,000 Provision for long service leave Total Liabilities 1,216,000 1,096,000 Activate Windows NET ASSETS 948,000 932,000 Go to Settings to activate Windows. Page 3 of 10 1445 words + 93% 4:25 PM H Type here to search O Xd XI Ed WE A CO 8/2/2021Special-Supplementary Alternative Assessment Task- Takehome EXAM, ACC2CRE, SEM 1 2021.docx (Protected View) - Word (Product Activation Failed) X File Home Insert Design Layout References Mailings Review View Add-ins Tell me what you want to do.. Aftab Mirza Share PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing X Taxation worksheet for Bundoora Ltd for the year ended 30 June 2021 Tax Current Extract Tax Bases expense tax from Deductible Taxable payable Items Statement temporary temporary of Financial differences differences Position ASSETS Cash 396,000 896,000 Inventory 312,000 $12,000 Receivables 240,000 0,000 Prepaid insurance 16,00 Plant 1,200,000 1,080,000 Total Asgets 2,164,000 2,028,000 LIABILITIES Accounts Payable 500,000 500,000 Provision for 50,000 warranty expense Loan payable 596,000 96,000 Provision for long 50,000 service leave Total Liabilities 1,216,000 1,096,000 NET ASSETS 948,000 32,000 Temporary differences at end of period Less Prior period amounts Movement for the period Tax effected at 30 % Tax on taxable income Activate Windows Income tax adjustments Go to Settings to activate Windows. Page 5 of 10 1445 words + 66% 4:26 PM H Type here to search BOOM Xd d WE A CO 8/2/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts