Question: A business makes a provision for doubtful debts equal to 5% of its trade receivables. At 31 March 2012, net trade receivables were shown in

A business makes a provision for doubtful debts equal to 5% of its trade receivables. At 31 March 2012, net trade receivables were shown in the Statement of Financial position as RM17,100. At 31 March 2013, the balance on its Sales Ledger Control account was RM19,000. In the year ended 31 March 2013, a bad debt of RM800 had been written off. How much should be debited in the Statement of Comprehensive Income for the year ended 31 March 2013 for the provision for doubtful debts?

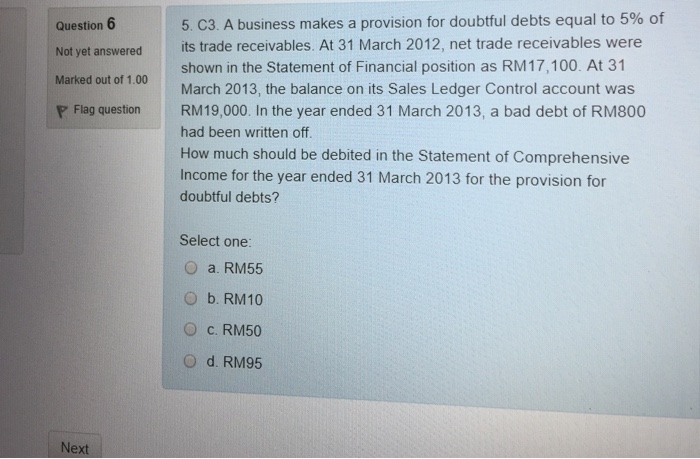

Question 6 Not yet answered Marked out of 1.00 P Flag question 5. C3. A business makes a provision for doubtful debts equal to 5% of its trade receivables. At 31 March 2012, net trade receivables were shown in the Statement of Financial position as RM17,100. At 31 March 2013, the balance on its Sales Ledger Control account was RM19,000. In the year ended 31 March 2013, a bad debt of RM800 had been written off How much should be debited in the Statement of Comprehensive Income for the year ended 31 March 2013 for the provision for doubtful debts? Select one O a. RM55 O b. RM10 ? ?. RM50 O d. RM95 Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock