Question: (a) By giving a relevant example for each type of risks, discuss why are some risks diversifiable and some non-diversifiable. (b) Consider the following three

(a) By giving a relevant example for each type of risks, discuss why are some risks diversifiable and some non-diversifiable.

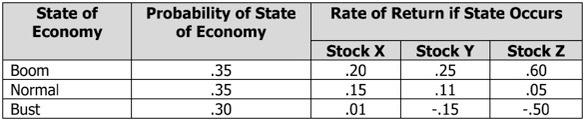

(b) Consider the following three stocks:

Calculate the following if your portfolio is invested 40 percent each in Stock X and Stock Y and 20 percent in Stock Z:

(i) The portfolio expected return.

(ii) The variance.

(iii) The standard deviation.

Rate of Return if State Occurs State of Economy Probability of State of Economy Boom Normal Bust .35 .35 .30 Stock X .20 .15 .01 Stock Y .25 .11 -.15 Stock Z .60 .05 -.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts