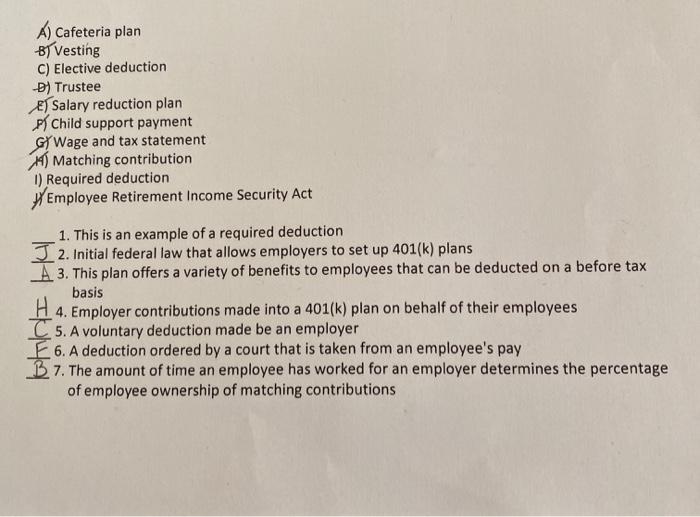

Question: A) Cafeteria plan 81 Vesting C) Elective deduction -) Trustee El Salary reduction plan F) Child support payment G Wage and tax statement M Matching

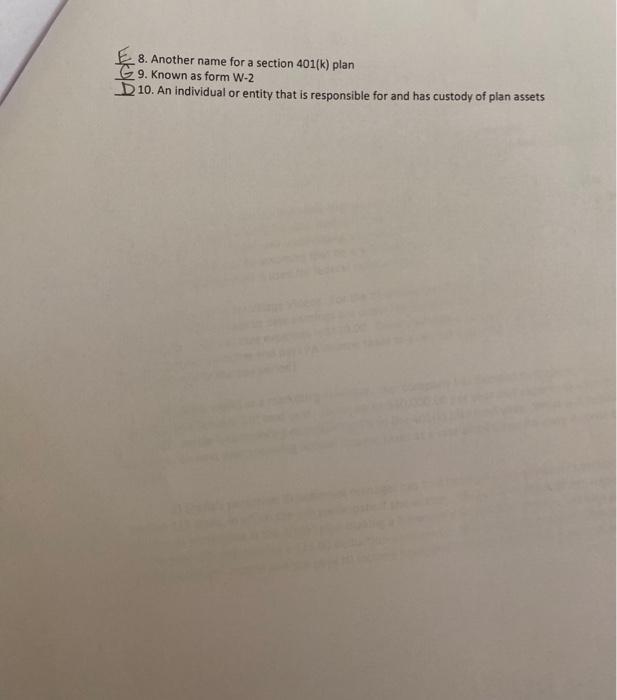

A) Cafeteria plan 81 Vesting C) Elective deduction -) Trustee El Salary reduction plan F) Child support payment G Wage and tax statement M Matching contribution 1) Required deduction Employee Retirement Income Security Act 1. This is an example of a required deduction J 2. Initial federal law that allows employers to set up 401(k) plans A 3. This plan offers a variety of benefits to employees that can be deducted on a before tax basis H 4. Employer contributions made into a 401(k) plan on behalf of their employees C 5. A voluntary deduction made be an employer E 6. A deduction ordered by a court that is taken from an employee's pay B 7. The amount of time an employee has worked for an employer determines the percentage of employee ownership of matching contributions blom 8. Another name for a section 401(k) plan 9. Known as form W-2 D 10. An individual or entity that is responsible for and has custody of plan assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts