Question: a. Calculate average, standard deviation and coefficient of variation for past returns of each stock. Assume equal weights. b. Consider the case of an investor

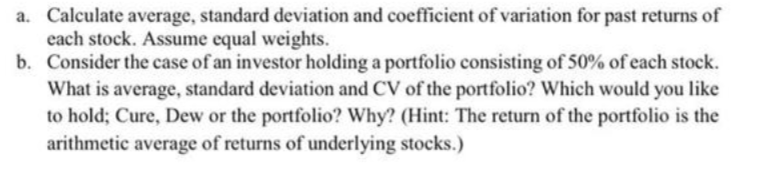

a. Calculate average, standard deviation and coefficient of variation for past returns of each stock. Assume equal weights. b. Consider the case of an investor holding a portfolio consisting of 50% of each stock. What is average, standard deviation and CV of the portfolio? Which would you like to hold; Cure, Dew or the portfolio? Why? (Hint: The return of the portfolio is the arithmetic average of returns of underlying stocks.) a. Calculate average, standard deviation and coefficient of variation for past returns of each stock. Assume equal weights. b. Consider the case of an investor holding a portfolio consisting of 50% of each stock. What is average, standard deviation and CV of the portfolio? Which would you like to hold; Cure, Dew or the portfolio? Why? (Hint: The return of the portfolio is the arithmetic average of returns of underlying stocks.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts