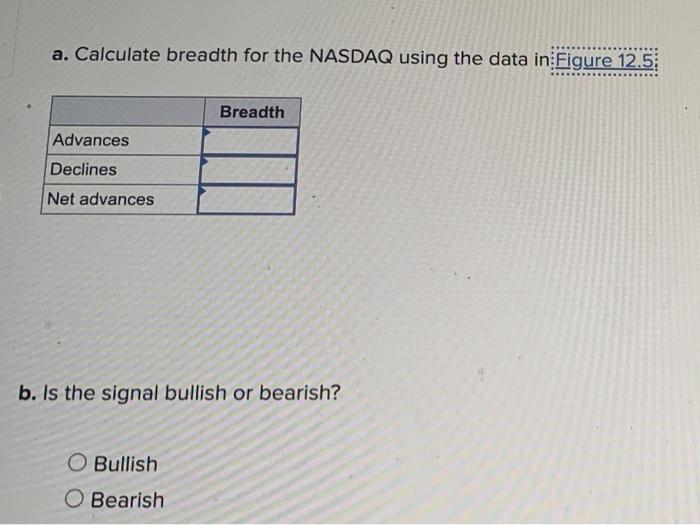

Question: a. Calculate breadth for the NASDAQ using the data in Figure 12.5 Breadth Advances Declines Net advances b. Is the signal bullish or bearish? O

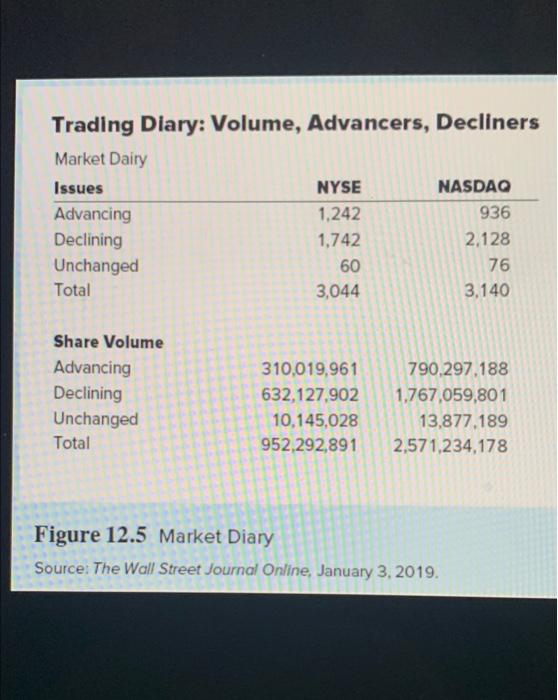

a. Calculate breadth for the NASDAQ using the data in Figure 12.5 Breadth Advances Declines Net advances b. Is the signal bullish or bearish? O Bullish O Bearish Trading Diary: Volume, Advancers, Decliners Market Dairy Issues NYSE NASDAQ Advancing 1,242 936 Declining 1,742 2.128 Unchanged 60 76 Total 3,044 3.140 Share Volume Advancing Declining Unchanged Total 310,019,961 632,127,902 10.145,028 952,292,891 790,297,188 1,767,059,801 13,877.189 2,571,234,178 Figure 12.5 Market Diary Source: The Wall Street Journal Online, January 3, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts