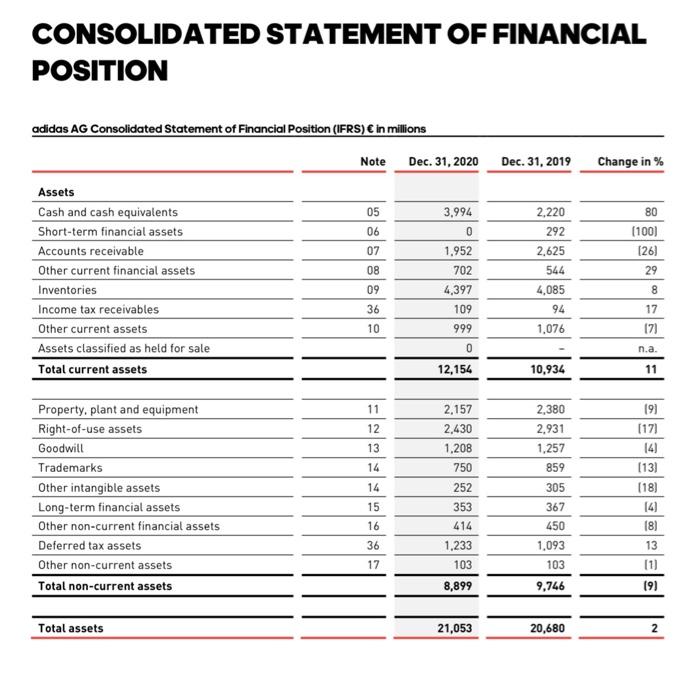

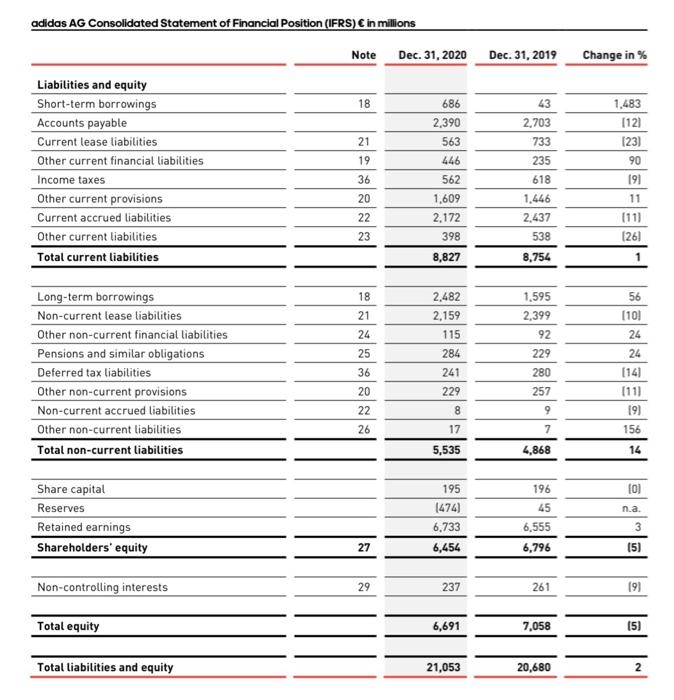

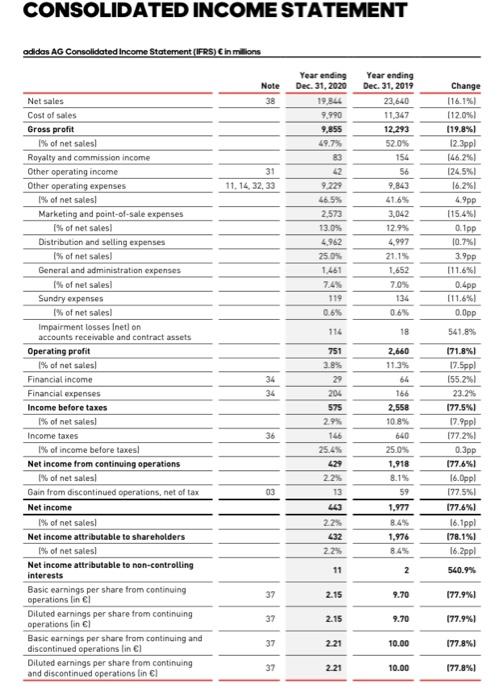

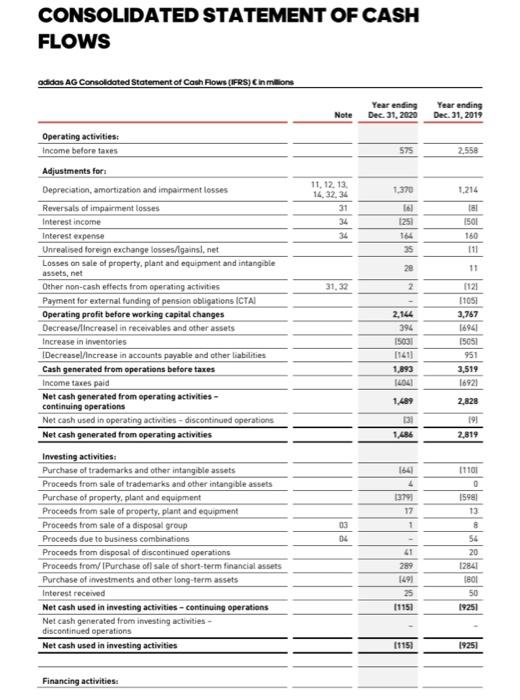

Question: a) calculate Return on Assets b) caculate operating margin c) calculate operating flow to total liabilites all information are provided CONSOLIDATED STATEMENT OF FINANCIAL POSITION

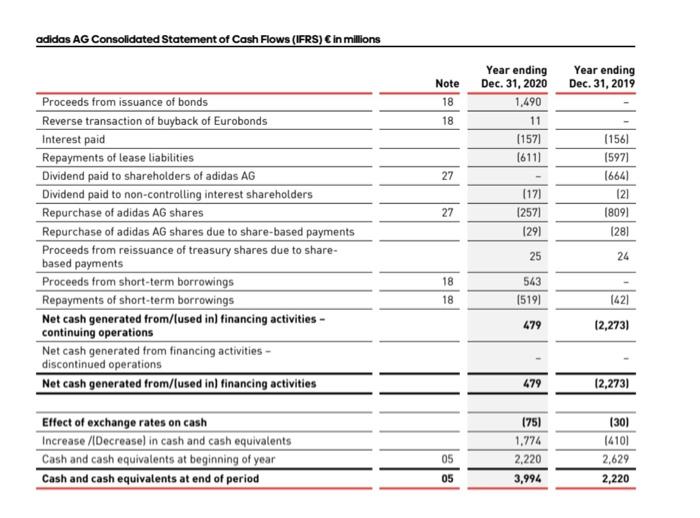

CONSOLIDATED STATEMENT OF FINANCIAL POSITION adidas AG Consolidated Statement of Financial Position (IFRS) in millions Note Dec. 31, 2020 Dec. 31, 2019 Change in % 05 06 07 3,994 0 1,952 702 4,397 109 Assets Cash and cash equivalents Short-term financial assets Accounts receivable Other current financial assets Inventories Income tax receivables Other current assets Assets classified as held for sale Total current assets 80 (100) (26) 29 08 2,220 92 2,625 544 4,085 94 1,076 09 8 17 36 10 999 17 n.a. 0 12,154 10,934 11 11 12 2.157 2.430 1,208 13 2.380 2,931 1.257 859 305 14 750 14 252 Property, plant and equipment Right-of-use assets Goodwill Trademarks Other intangible assets Long-term financial assets Other non-current financial assets Deferred tax assets Other non-current assets Total non-current assets 191 (171 14 (13) (18) 14) 18] 13 (1) 19) 15 367 16 353 414 1,233 36 450 1,093 103 9,746 17 103 8,899 Total assets 21,053 20,680 2 adidas AG Consolidated Statement of Financial Position (IFRS) in milions Note Dec. 31, 2020 Dec. 31, 2019 Change in % 18 43 2.703 733 21 19 Liabilities and equity Short-term borrowings Accounts payable Current lease liabilities Other current financial liabilities Income taxes Other current provisions Current accrued liabilities Other current liabilities Total current liabilities 686 2,390 563 446 562 1,609 2.172 398 235 618 1.483 (12) (23) 90 191 11 (11) (26) 36 20 22 1.446 2,437 538 23 8,827 8,754 1 18 21 24 25 2,482 2,159 115 284 1.595 2.399 92 229 Long-term borrowings Non-current lease liabilities Other non-current financial liabilities Pensions and similar obligations Deferred tax liabilities Other non-current provisions Non-current accrued liabilities Other non-current liabilities Total non-current liabilities 56 1101 24 24 (14) 1111 36 241 280 20 257 229 8 22 9 26 17 7 5,535 4,868 196 45 Share capital Reserves Retained earnings Shareholders' equity 195 (474) 6,733 6,454 6.555 LILLA JALALE 27 6,796 Non-controlling interests 29 237 261 Total equity 6,691 7,058 Total liabilities and equity 21,053 20,680 CONSOLIDATED INCOME STATEMENT adidas AG Consolidated Income Statement (IFRS) Cin millions Note 38 Year ending Dec. 31, 2020 19.346 9.990 9,855 49.7% 83 42 9.229 46.5% 2,573 13.0% 4.962 25.0% 31 11, 14, 32, 33 Year ending Dec 31, 2019 23,640 11.347 12.293 52.0% 154 56 9.843 41.6% 3,042 12.9% 4.997 21.1% 1,652 7.0% 134 0.6% Change 116.1% [12.0% (19.8%) 12.3ppl 146.2%) 124.5% 16.2%) 4.9 pp 115.4%) 0100 10.7% 3.9pp [11.6% 0.4pp (11.6% 0. Opp 1.461 7.4% 119 0.6% 316 18 541.8% 751 2,660 11.3% 64 Net sales Cost of sales Gross profit 1% of net sales! Royalty and commission income Other operating income Other operating expenses 1% of net sales! Marketing and point-of-sale expenses 1% of net sales! Distribution and selling expenses 1% of net sales General and administration expenses 1% of net sales! Sundry expenses 1% of net sales! Impairment losses Intl on accounts receivable and contract assets Operating profit % of net sales! Financial income Financial expenses Income before taxes 1% of net sales! Income taxes 1% of income before taxes Net income from continuing operations % of net sales! Gain from discontinued operations, net of tax Net income 1% of net sales! Net income attributable to shareholders 1% of net sales Net income attributable to non-controlling interests Basic earnings per share from continuing operations line Diluted earnings per share from continuing operations in Basic earnings per share from continuing and discontinued operations lin El Diluted earnings per share from continuing and discontinued operations in El 34 34 166 29 204 575 2.9% 36 25.45 429 2.2% 13 44 2,558 10.8% 640 25.0% 1.918 8.1% 59 1.977 8.4% 1.976 8.4% 171.8%) 17.5ppl 155.2% 23.2% 177.5%) 17. Oppl 197.2% 0.3pp 177.6% 16.Oppl 177.5% 177.6%) 16.1ppl 178.1% 16.ppl 03 2.2% 432 22% 11 2 540.9% 37 2.15 9.70 177.9% 37 2.15 9.70 177.9%) 37 221 10.00 177.8%) 37 2.21 10.00 177.8%) CONSOLIDATED STATEMENT OF CASH FLOWS adidas AG Consolidated Statement of Cash Flows (IFRS) Cin millions Note Year ending Dec 31, 2020 Year ending Dec 31, 2019 575 2,558 1.370 1.214 11, 12, 13, 14,32,34 31 34 34 125 164 35 tal 1501 160 111 20 11 31,32 2 2,144 394 15031 1141) 1,893 14041 1121 11051 3,767 16941 15051 951 3,519 16921 Operating activities: Income before taxes Adjustments for Depreciation, amortization and impairment losses Reversals of impairment losses Interest income Interest expense Unrealised foreign exchange losses/gains, net Losses on sale of property, plant and equipment and intangible assets, net Other non-cash effects from operating activities Payment for external funding of pension obligations ICTAI Operating profit before working capital changes Decrease/Increasel in receivables and other assets Increase in inventories Decrease/Increase in accounts payable and other liabilities Cash generated from operations before taxes Income taxes paid Net cash generated from operating activities - continuing operations Net cash used in operating activities - discontinued operations Net cash generated from operating activities Investing activities: Purchase of trademarks and other intangible assets Proceeds from sale of trademarks and other intangible assets Purchase of property, plant and equipment Proceeds from sale of property, plant and equipment Proceeds from sale of a disposal group Proceeds due to business combinations Proceeds from disposal of discontinued operations Proceeds from/IPurchase of sale of short-term financial assets Purchase of investments and other long-term assets Interest received Net cash used in investing activities - continuing operations Net cash generated from investing activities discontinued operations Net cash used in investing activities 1.489 2,820 131 1.486 19 2,819 11101 0 1641 4 3791 17 1 03 04 41 289 1491 25 11151 15981 13 8 54 20 1284 1801 50 19251 (1151 19251 Financing activities: adidas AG Consolidated Statement of Cash Flows (IFRS) Cin millions Note Year ending Dec. 31, 2019 18 18 Year ending Dec. 31, 2020 1,490 11 (1571 (6111 27 (1561 (597) 1664) 121 (809) (281 27 (17) (257) 1291 Proceeds from issuance of bonds Reverse transaction of buyback of Eurobonds Interest paid Repayments of lease liabilities Dividend paid to shareholders of adidas AG Dividend paid to non-controlling interest shareholders Repurchase of adidas AG shares Repurchase of adidas AG shares due to share-based payments Proceeds from reissuance of treasury shares due to share- based payments Proceeds from short-term borrowings Repayments of short-term borrowings Net cash generated from/lused in) financing activities - continuing operations Net cash generated from financing activities - discontinued operations Net cash generated from/lused in) financing activities 25 24 18 18 543 (519) 1421 479 (2,273) 479 12,273) Effect of exchange rates on cash Increase /Decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of period 1751 1.774 2,220 3,994 (30) (410) 2,629 2,220 05 05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts