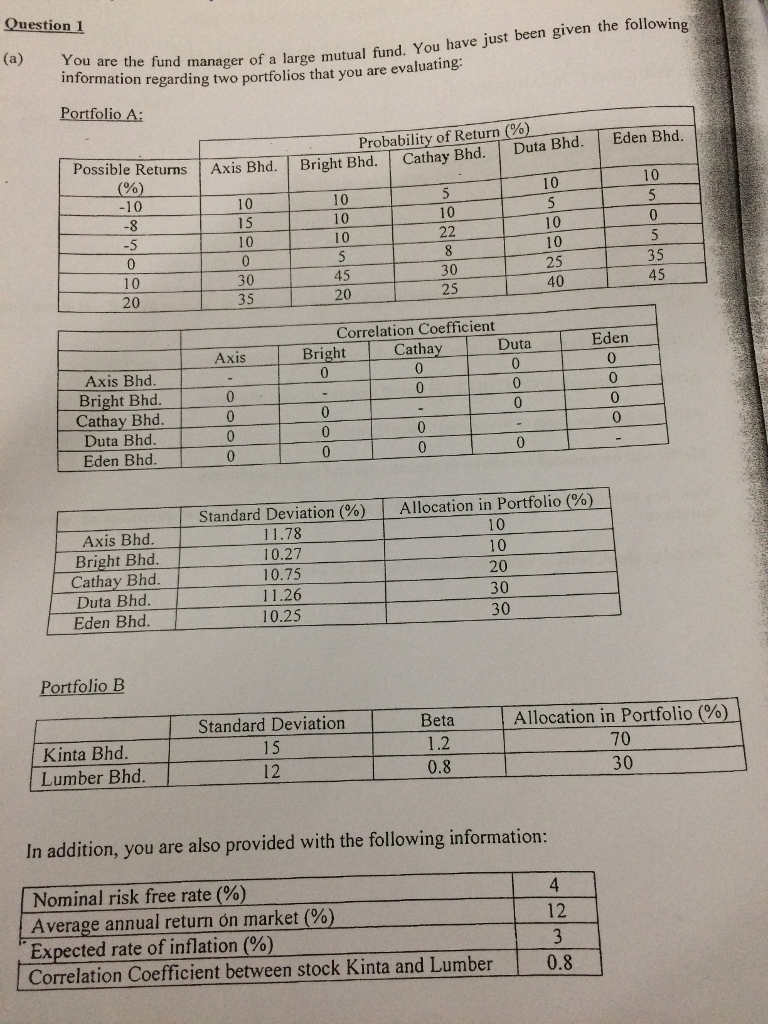

Question: (a) Calculate the expected return, standard deviation for both portfolio A and portfolio B. (b) Select the best portfolio between portfolio A and portfolio B

(a) Calculate the expected return, standard deviation for both portfolio A and portfolio B.

(b) Select the best portfolio between portfolio A and portfolio B based on the andwer above.

(c) Explain what would happen to the standard deviation if you were to add another 20 stocks to it.

Question 1 information regar manager of a large mutual fund. You have just been given the following Portfolio A: regarding two portfolios that you are evaluating: Probability of Return (%) cturns Axis Bha.Bright Bhd. Cathay Bhd. Duta Bhd. Eden Bhd 1%) 10 10 10 10 15 1 0 10 10 10 10 10 10 25 40 10 20 30 35 45 20 30 25 35 45 Correlation Coefficient Eden 0 0 Axis Bright Cathay Duta Axis Bhd Bright Bho. Cathay Bhod 0 Duta Bhd Eden Bhod 0 1 | Standard Deviation (96) 11.78 0.27 10.75 11.26 10.25 Allocation in Portfolio (96) 10 10 20 30 30 Axis Bhod Bright Bhd Cathay Bho Duta Bhd Eden Bhd Portfolio B Kinta Bhd Lumber Bhd Standard Deviatiorn 15 12 Beta 1.2 0.8 Allocation in Portfolio (%) 70 30 In addition, you are also provided with the following information: Nominal risk free rate (%) Average annual return on market (%) Expected rate of inflation (%) Correlation Coefficient between stock Kinta and Lumber0.8 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts