Question: A. Calculate the expected returns for the stock and bond in this setting. B. Calculate the variance and standard deviations for the stock and bond

A. Calculate the expected returns for the stock and bond in this setting. B. Calculate the variance and standard deviations for the stock and bond returns in this setting.

C. Calculate the covariance and correlation for the stock and bond returns in this setting.

E. Calculate the Sharpe Ratio for the portfolios in Part D assuming a risk-free asset exists with a return of 0.5%. Which of these portfolios would most likely be the tangency portfolio and why?

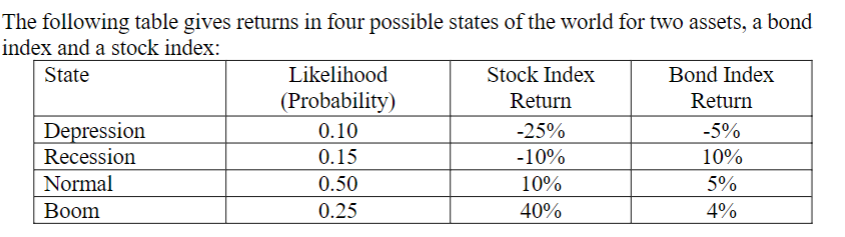

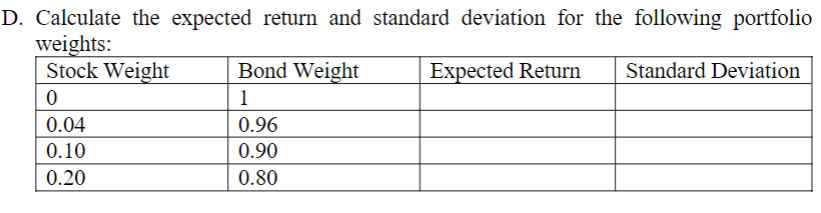

The following table gives returns in four possible states of the world for two assets, a bond index and a stock index: State Likelihood Stock Index Bond Index (Probability) Return Return Depression 0.10 -25% -5% Recession 0.15 -10% 10% Normal 0.50 10% 5% Boom 0.25 40% 4% D. Calculate the expected return and standard deviation for the following portfolio weights: Stock Weight Bond Weight Expected Return Standard Deviation 0 1 0.04 0.96 0.10 0.90 0.20 0.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts