Question: (a) Calculate the gain or loss on exchange difference for the following situations: i. Geed Sdn Bhd established in 2015 with one small boutique

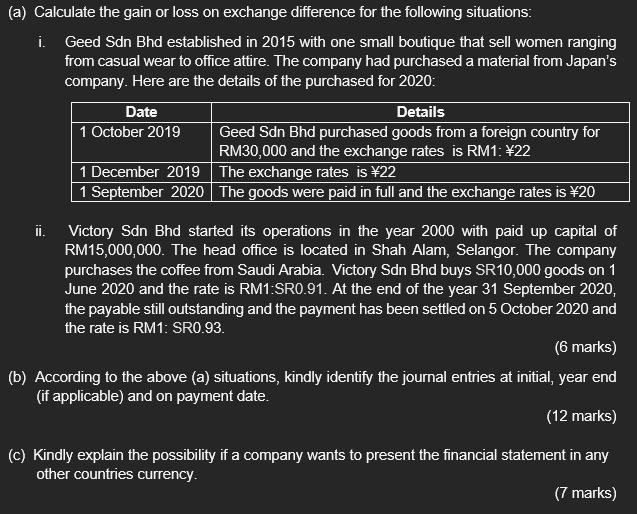

(a) Calculate the gain or loss on exchange difference for the following situations: i. Geed Sdn Bhd established in 2015 with one small boutique that sell women ranging from casual wear to office attire. The company had purchased a material from Japan's company. Here are the details of the purchased for 2020: Date Details Geed Sdn Bhd purchased goods from a foreign country for RM30,000 and the exchange rates is RM1: 22 1 October 2019 1 December 2019 1 September 2020 The goods were paid in full and the exchange rates is 20 The exchange rates is 22 ii. Victory Sdn Bhd started its operations in the year 2000 with paid up capital of RM15,000,000. The head office is located in Shah Alam, Selangor. The company purchases the coffee from Saudi Arabia. Victory Sdn Bhd buys SR10,000 goods on 1 June 2020 and the rate is RM1:SRO.91. At the end of the year 31 September 2020, the payable still outstanding and the payment has been settled on 5 October 2020 and the rate is RM1: SRO.93. (6 marks) (b) According to the above (a) situations, kindly identify the journal entries at initial, year end (if applicable) and on payment date. (12 marks) (c) Kindly explain the possibility if a company wants to present the financial statement in any other countries currency. (7 marks)

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Explanation C i A reporting currency must be one c... View full answer

Get step-by-step solutions from verified subject matter experts