Question: a. Calculate the i.) expected return on BrunoMaster, E(R B ). ii.) expected return on NewTorch, E(R N ). iii.) expected return on the portfolio,

a. Calculate the

a. Calculate the

i.) expected return on BrunoMaster, E(RB).

ii.) expected return on NewTorch, E(RN).

iii.) expected return on the portfolio, E(Rp).

b. Calculate the portfolio standard deviation, p.

c. Calculate the covariance and the correlation coefficient. How does the correlation coefficient explain the results?

d. Assume the correlations of -.5, 0, .5 and 1. Recalculate the portfolio risk measures with these correlations. Explain how your results change.

B. You have been researching FluidMotion now want to consider adding this third asset to your original portfolio. FluidMotion has returns of 5, 2, 0 and 2% (.05, .02, 0.0, .02) expected under the four states from Boom through Depression respectively.

You plan to investment $24000 in BrunoMaster, $15000 in NewTorch and the remainder in FluidMotion.

a. Calculate the expected return on this new portfolio.

b. Calculate the covariances between the three assets?

c. Calculate the variance and standard deviation of this new portfolio.

d. How do the results of this portfolio compare to the results of the prior two asset portfolio? Explain.

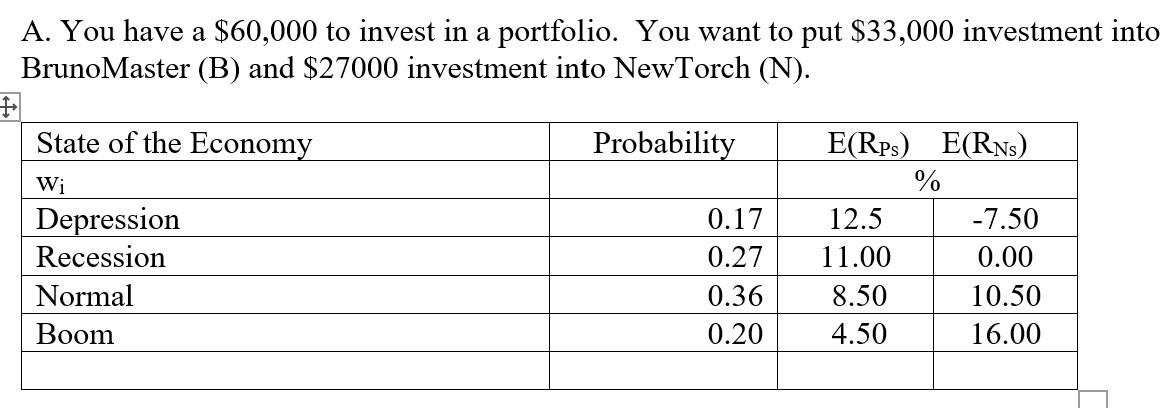

A. You have a $60,000 to invest in a portfolio. You want to put $33,000 investment into Bruno Master (B) and $27000 investment into NewTorch (N). State of the Economy Probability Wi Depression Recession Normal Boom 0.17 0.27 0.36 0.20 E(Rp) E(RN) % 12.5 -7.50 11.00 0.00 8.50 10.50 4.50 16.00 A. You have a $60,000 to invest in a portfolio. You want to put $33,000 investment into Bruno Master (B) and $27000 investment into NewTorch (N). State of the Economy Probability Wi Depression Recession Normal Boom 0.17 0.27 0.36 0.20 E(Rp) E(RN) % 12.5 -7.50 11.00 0.00 8.50 10.50 4.50 16.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts