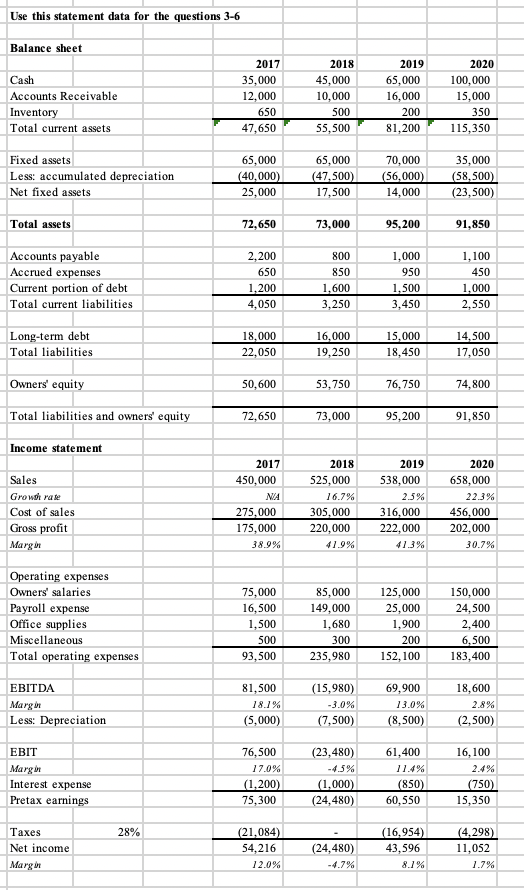

Question: A. Calculate the net capital spending for 2019 and 2020 B.How long, on average, did it take the company to collect on accounts receivable in

A. Calculate the net capital spending for 2019 and 2020

B.How long, on average, did it take the company to collect on accounts receivable in 2020?

C.Calculate the cash flow from assets for 2020

D.What was the return on assets for 2020?

Use this statement data for the questions 3-6 Balance sheet Cash Accounts Receivable Inventory Total current assets 2017 35,000 12,000 650 47,650 2018 45,000 10,000 500 55,500 2019 65,000 16,000 200 81,200 2020 100,000 15,000 350 115,350 Fixed assets Less: accumulated depreciation Net fixed assets 65,000 (40,000) 25,000 65,000 (47,500) 17,500 70,000 (56,000) 14,000 35,000 (58,500) (23,500) Total assets 72,650 73,000 95,200 91,850 Accounts payable Accrued expenses Current portion of debt Total current liabilities 2,200 650 1,200 4,050 800 850 1,600 3,250 1,000 950 1,500 3,450 1,100 450 1,000 2,550 Long-term debt Total liabilities 18,000 22,050 16,000 19,250 15,000 18,450 14,500 17,050 Owners' equity 50,600 53,750 76,750 74,800 Total liabilities and owners' equity 72,650 73,000 95,200 91,850 Income statement Sales Grower rate Cost of sales Gross profit Margin 2017 450,000 NA 275,000 175,000 38.9% 2018 525,000 16.7% 305.000 220,000 +1.9% 2019 538,000 2.5% 316,000 222,000 41.3% 2020 658,000 22.3% 456,000 202,000 30.7% Operating expenses Owners' salaries Payroll expense Office supplies Miscellaneous Total operating expenses 75,000 16,500 1,500 500 93,500 85,000 149,000 1,680 125,000 25,000 1,900 200 152, 100 150,000 24,500 2,400 6,500 183,400 300 235,980 EBITDA Margir Less: Depreciation 81,500 18.1% (5,000) (15,980) -3.0% (7,500) 69,900 13.0% (8,500) 18,600 2.8% (2,500) 16,100 EBIT Margir Interest expense Pretax earnings 76,500 17.0% (1,200) 75,300 (23,480) -4.5% (1,000) (24,480) 61,400 11.4% (850) 60,550 (750) 15,350 28% Taxes Net income Margi (21,084) 54,216 12.0% (24,480) -4.7% (16,954) 43,596 8.1% (4,298) 11,052 1.7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts