Question: A - Calculate the NPV for each machine over is life. Rank the machines in descending order on the basis of NPV. B - Use

A - Calculate the NPV for each machine over is life. Rank the machines in descending order on the basis of NPV.

B - Use the annualized net present value (ANPV) approach to evaluate and rank the machines in descending order on the basis of ANPV.

C - Compare and contrasts your findings in part A and B. Which machine would you recommend that the firm acquire? Why?

PLEASE SHOW ALL WORK - NEED TO BE ABLE TO UNDERSTAND HOW ANSWERS WERE CALCULATED

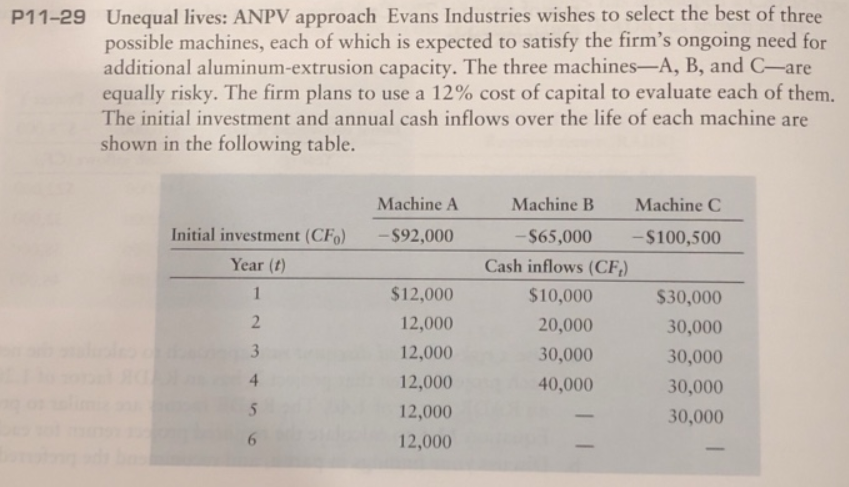

P11-29 Unequal lives: ANPV approach Evans Industries wishes to select the best of three possible machines, each of which is expected to satisfy the firm's ongoing need for additional aluminum-extrusion capacity. The three machines-A, B, and C-are equally risky. The firm plans to use a 12% cost of capital to evaluate each of them. The initial investment and annual cash inflows over the life of each machine are shown in the following table. Machine A - $92,000 Initial investment (CF) Year (t) Machine B Machine C -$65,000 - $100,500 Cash inflows (CF) $10,000 $30,000 20,000 30,000 30,000 30,000 40,000 30,000 30,000 $12,000 12,000 12,000 12,000 12,000 12,000 2 3 4 5 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts