Question: (a) Calculate the portfolio expected return. (b) Calculate the variance and the standard deviation of the portfolio. (C) If the expected T-bill rate is 3.80

(a) Calculate the portfolio expected return. (b) Calculate the variance and the standard deviation of the portfolio.

(C)

If the expected T-bill rate is 3.80 percent, calculate the expected risk premium on the portfolio.

(d) If the market index fund has the same expected return as your portfolio, without considering any transaction cost, would you consider selling your portfolio and investing the market index fund instead? Explain your thoughts.

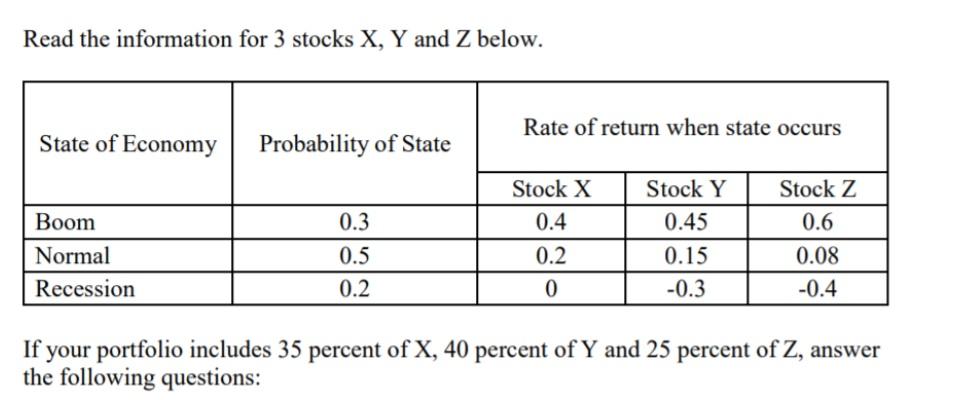

Read the information for 3 stocks X, Y and Z below. Rate of return when state occurs State of Economy Probability of State Stock Z 0.6 0.3 Boom Normal Recession Stock X 0.4 0.2 0 Stock Y 0.45 0.15 -0.3 0.5 0.2 0.08 -0.4 If your portfolio includes 35 percent of X, 40 percent of Y and 25 percent of Z, answer the following questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts