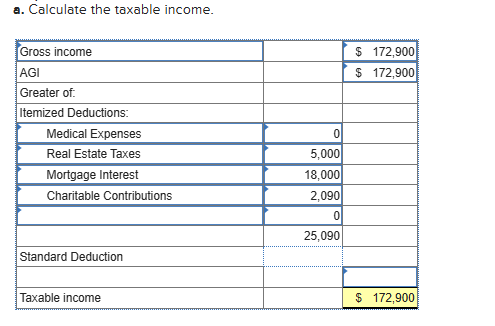

Question: a . Calculate the taxable income. begin { tabular } { | l | l | l | } hline Gross income &

a Calculate the taxable income. begintabularlllhline Gross income & & $ hline AGI & & $ hline Greater of: & & hline Itemized Deductions: & & hline Medical Expenses & & hline Real Estate Taxes & & hline Mortgage Interest & & hline Charitable Contributions & & hline & & hline & & hline Standard Deduction & & hline & & hline Taxable income & & $ hline endtabular Read the following letter and help Shady Slim with his tax situation. Please assume that his gross income is $ which consists only of salary for purposes of this problem.

December

To the friendly student tax preparer:

Hi it's Shady Slim again. I just got back from my th birthday party, and Im told that you need some more information

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock