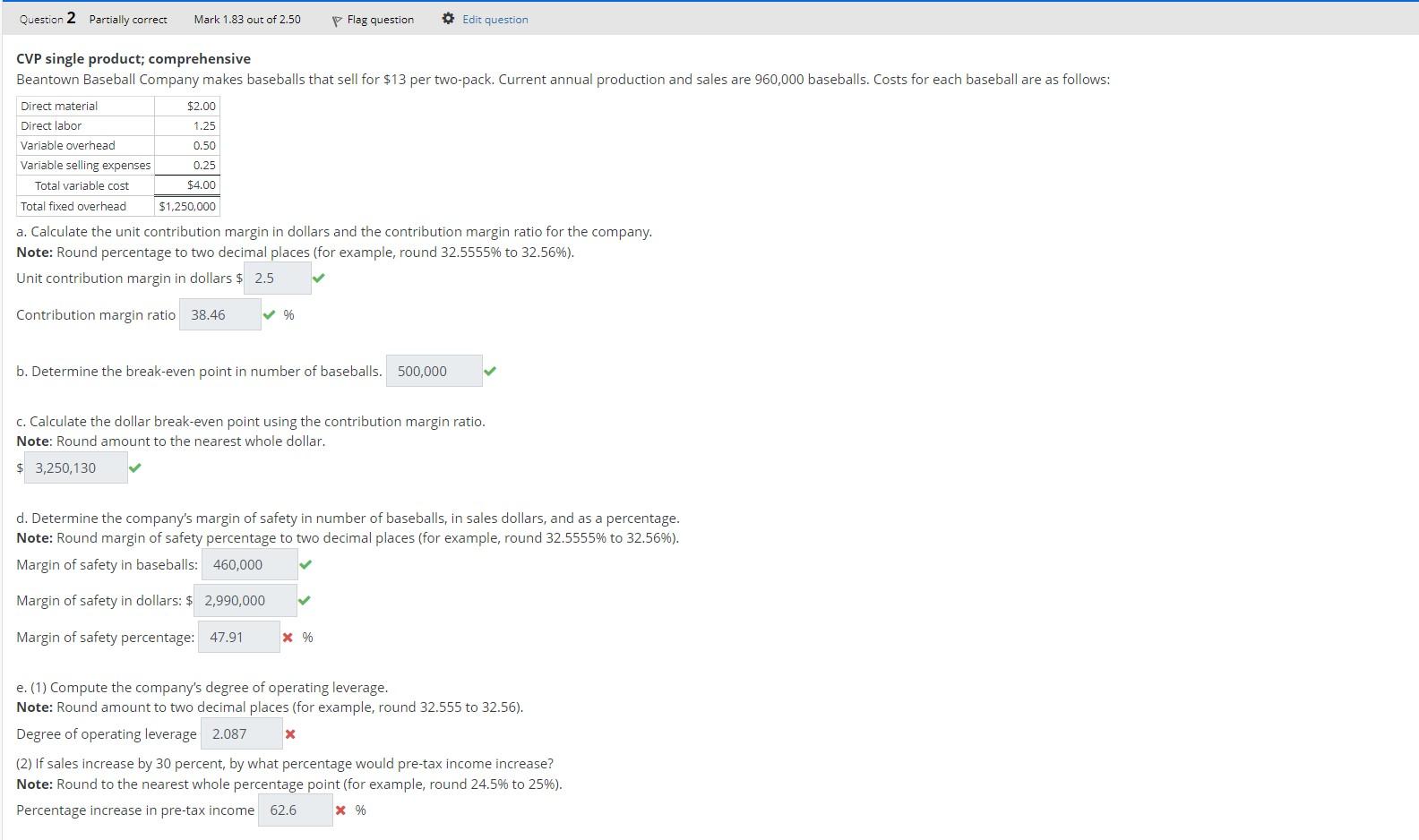

Question: a. Calculate the unit contribution margin in dollars and the contribution margin ratio for the company. Note: Round percentage to two decimal places (for example,

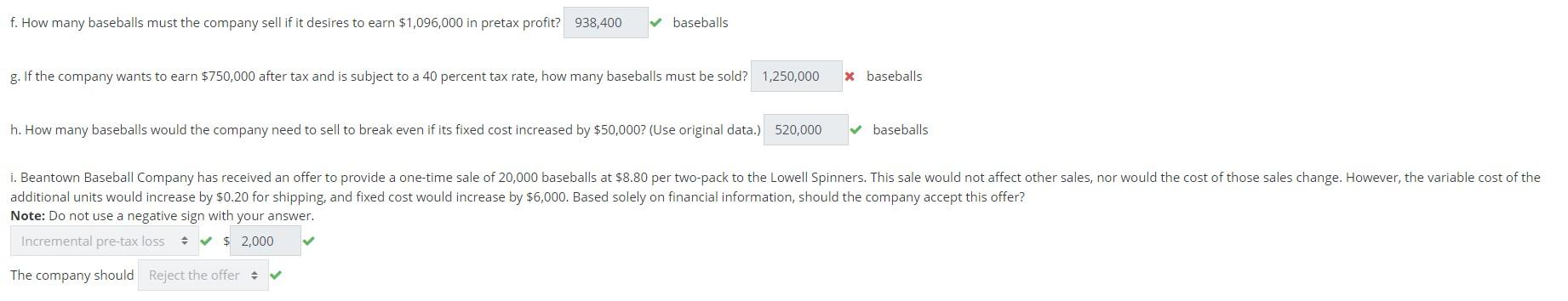

a. Calculate the unit contribution margin in dollars and the contribution margin ratio for the company. Note: Round percentage to two decimal places (for example, round 32.5555% to 32.56% ). Unit contribution margin in dollars q Contribution margin ratio % b. Determine the break-even point in number of baseballs. c. Calculate the dollar break-even point using the contribution margin ratio. Note: Round amount to the nearest whole dollar. d. Determine the company's margin of safety in number of baseballs, in sales dollars, and as a percentage. Note: Round margin of safety percentage to two decimal places (for example, round 32.5555% to 32.56% ). Margin of safety in baseballs: Margin of safety in dollars: \$ Margin of safety percentage: % e. (1) Compute the company's degree of operating leverage. Note: Round amount to two decimal places (for example, round 32.555 to 32.56 ). Degree of operating leverage (2) If sales increase by 30 percent, by what percentage would pre-tax income increase? Note: Round to the nearest whole percentage point (for example, round 24.5% to 25% ). Percentage increase in pre-tax income % lany baseballs must the company sell if it desires to earn $1,096,000 in pretax profit? baseballs company wants to earn $750,000 after tax and is subject to a 40 percent tax rate, how many baseballs must be sold? nany baseballs would the company need to sell to break even if its fixed cost increased by $50,000 ? (Use original data.) baseballs al units would increase by $0.20 for shipping, and fixed cost would increase by $6,000. Based solely on financial information, should the company accept this offer? not use a negative sign with your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts