Question: A call bull spread can be constructed by simultaneously buying a call option at a strike price of K and selling a call option

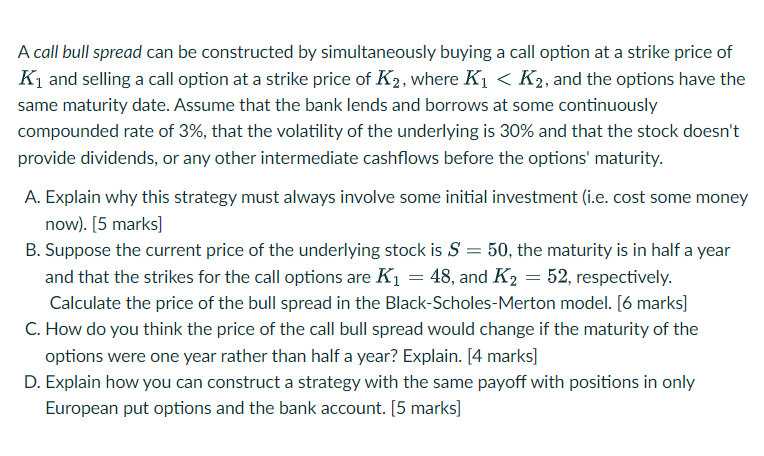

A call bull spread can be constructed by simultaneously buying a call option at a strike price of K and selling a call option at a strike price of K2, where K K2, and the options have the same maturity date. Assume that the bank lends and borrows at some continuously compounded rate of 3%, that the volatility of the underlying is 30% and that the stock doesn't provide dividends, or any other intermediate cashflows before the options' maturity. A. Explain why this strategy must always involve some initial investment (i.e. cost some money now). [5 marks] B. Suppose the current price of the underlying stock is S = 50, the maturity is in half a year and that the strikes for the call options are K = 48, and K = 52, respectively. Calculate the price of the bull spread in the Black-Scholes-Merton model. [6 marks] C. How do you think the price of the call bull spread would change if the maturity of the options were one year rather than half a year? Explain. [4 marks] D. Explain how you can construct a strategy with the same payoff with positions in only European put options and the bank account. [5 marks]

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Call Bull Spread Analysis A Initial Investment A call bull spread always involves an initial investment because Buy Option Cost You purchase a call op... View full answer

Get step-by-step solutions from verified subject matter experts