Question: A call option and put option with the same strike price $15 and maturity 1 year are on sales in the market. Their underlying

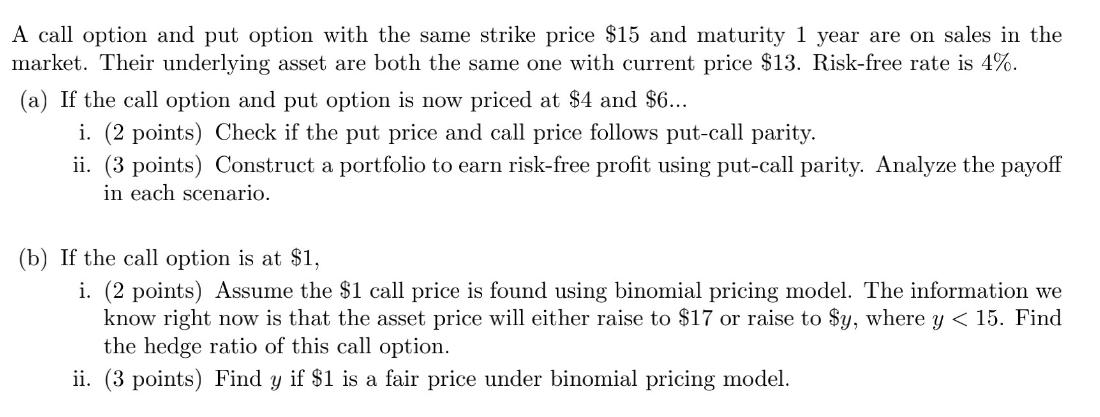

A call option and put option with the same strike price $15 and maturity 1 year are on sales in the market. Their underlying asset are both the same one with current price $13. Risk-free rate is 4%. (a) If the call option and put option is now priced at $4 and $6... i. (2 points) Check if the put price and call price follows put-call parity. ii. (3 points) Construct a portfolio to earn risk-free profit using put-call parity. Analyze the payoff in each scenario. (b) If the call option is at $1, i. (2 points) Assume the $1 call price is found using binomial pricing model. The information we know right now is that the asset price will either raise to $17 or raise to $y, where y < 15. Find the hedge ratio of this call option. ii. (3 points) Find y if $1 is a fair price under binomial pricing model.

Step by Step Solution

3.59 Rating (160 Votes )

There are 3 Steps involved in it

a I Putcall equality expresses that the amount of the call choice cost and the current worth of the strike cost rises to the amount of the put choice cost and the ongoing resource cost Numerically it ... View full answer

Get step-by-step solutions from verified subject matter experts