Question: A call option on a stock that does not pay dividends has the following parameter values (in the usual notation): S=240, K=250, T=0.5, r=0.06,

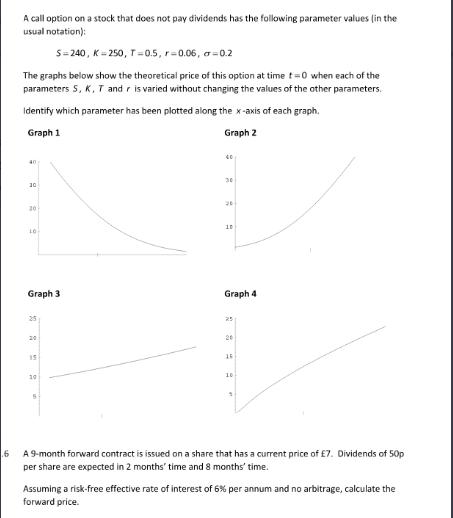

A call option on a stock that does not pay dividends has the following parameter values (in the usual notation): S=240, K=250, T=0.5, r=0.06, a=0.2 The graphs below show the theoretical price of this option at time t=0 when each of the parameters 5, K, T and r is varied without changing the values of the other parameters. Identify which parameter has been plotted along the x-axis of each graph. Graph 1 Graph 2 40 30 20 LO Graph 3 25 20 15 10 5 40 20 10 Graph 4 25 20 15 10 1 .6 A 9-month forward contract is issued on a share that has a current price of 7. Dividends of 50p per share are expected in 2 months' time and 8 months' time. Assuming a risk-free effective rate of interest of 6% per annum and no arbitrage, calculate the forward price.

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Present value of share price at end of 9 months The forward contract is for 9 months We need to calc... View full answer

Get step-by-step solutions from verified subject matter experts