Question: A call option on British pounds (E) exists with a strike price of $1.56 and a premium of $0.10 per unit. Another call option on

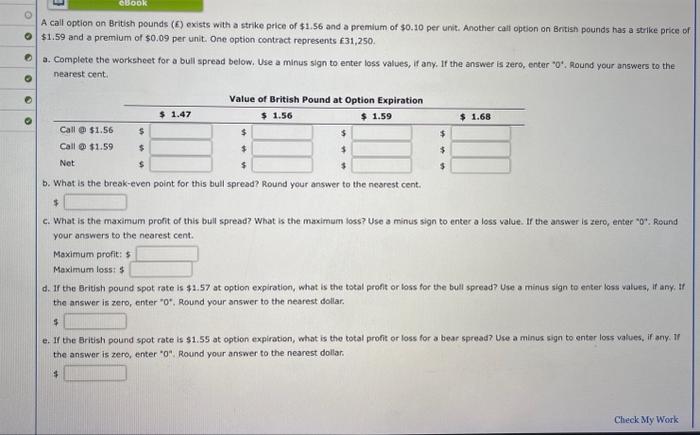

A call option on British pounds (E) exists with a strike price of $1.56 and a premium of $0.10 per unit. Another call option on Bntish pounds has a strike price os $1.59 and a premlum of $0.09 per unit. One option contract represents {31,250. a. Complete the worksheet for a bull spread below. Use a minus sign to enter loss values, if any. If the answer is zero, enter "0". Round your answers to the nearest cent. b. What 15 the break-even point for this bull spread? Round your answer to the nearest cent. c. What is the maximum profit of this bull spread? What is the maximum loss? Use a minus sign to enter a loss value. If the answer is zero, enter "O-. Round your answers to the nearest cent. Maximum profit: $ Maximum loss: $ d. If the British pound spot rate is $1.57 at option expiration, what is the total proft or loss for the bull spread? Use a minus sign to enter loss vatues, If any. If the answer is zero, enter " 0%. Round your answer to the nearest dollar. 5 e. If the British pound spot rate is $1.55 at option expiration, what is the total profit or loss for a bear spread? Use a minus sign to enter loss values, if any, 1f the answer is zero, enter " 0 : Round your answer to the nearest dollar: 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts