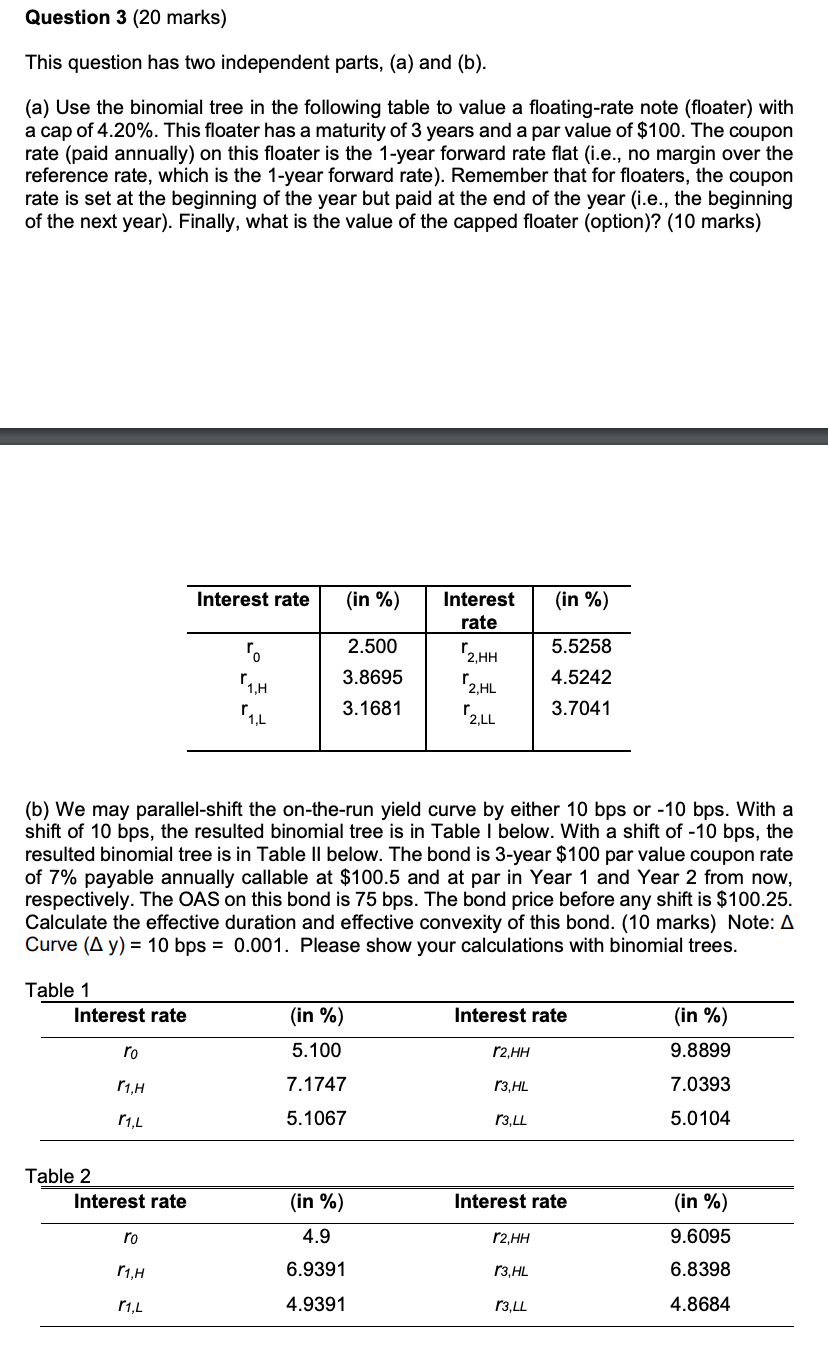

Question: a cap of ( 4 . 2 0 % ) . This floater has a maturity of 3 years and a par

a cap of This floater has a maturity of years and a par value of $ The coupon rate paid annually on this floater is the year forward rate flat ie no margin over the reference rate, which is the year forward rate Remember that for floaters, the coupon rate is set at the beginning of the year but paid at the end of the year ie the beginning of the next year Finally, what is the value of the capped floater option marks

b We may parallelshift the ontherun yield curve by either bps or bps With a shift of bps the resulted binomial tree is in Table I below. With a shift of bps the resulted binomial tree is in Table II below. The bond is year $ par value coupon rate of payable annually callable at $ and at par in Year and Year from now, respectively. The OAS on this bond is bps The bond price before any shift is $ Calculate the effective duration and effective convexity of this bond. marks Note: Delta Curve Delta mathrmymathrmbps Please show your calculations with binomial trees.

Table

Table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock