Question: A Capital Budgeting Problem A cargo company is evaluating whether to replace an existing cargo ship with a new ship or repair the current

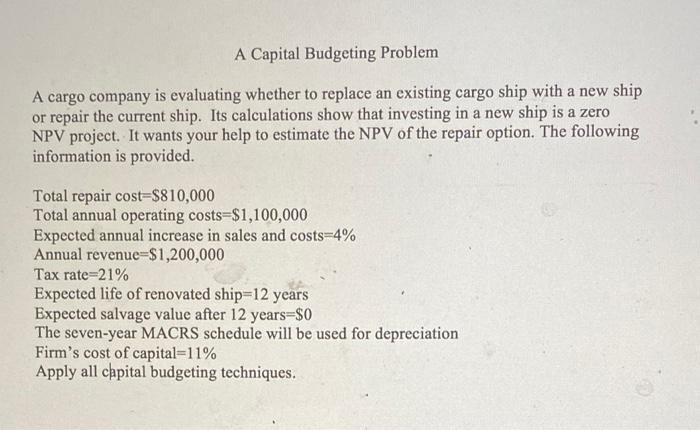

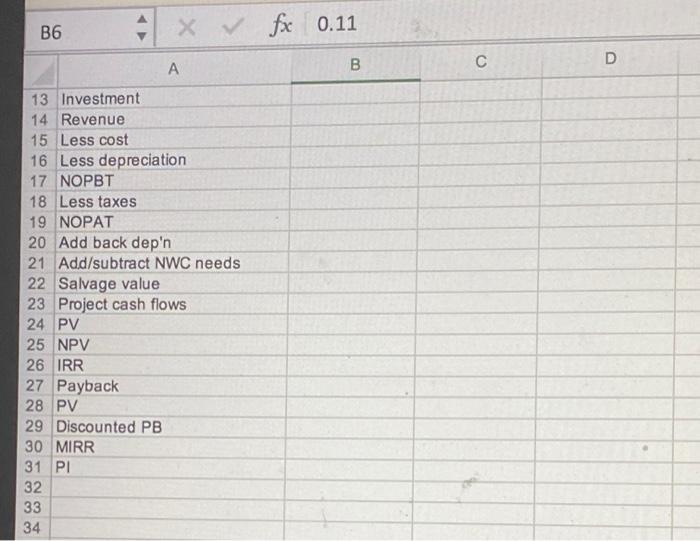

A Capital Budgeting Problem A cargo company is evaluating whether to replace an existing cargo ship with a new ship or repair the current ship. Its calculations show that investing in a new ship is a zero NPV project. It wants your help to estimate the NPV of the repair option. The following information is provided. Total repair cost=$810,000 Total annual operating costs-$1,100,000 Expected annual increase in sales and costs-4% Annual revenue-$1,200,000 Tax rate-21% Expected life of renovated ship-12 years Expected salvage value after 12 years=$0 The seven-year MACRS schedule will be used for depreciation Firm's cost of capital=11% Apply all chpital budgeting techniques. B6 fx 0.11 C A 13 Investment 14 Revenue 15 Less cost 16 Less depreciation 17 NOPBT 18 Less taxes 19 NOPAT 20 Add back dep'n 21 Add/subtract NWC needs 22 Salvage value 23 Project cash flows 24 PV 25 NPV 26 IRR 27 Payback 28 PV 29 Discounted PB 30 MIRR 31 PI 32 33 34

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

In the given problem Depreciation is calculated on the basis of MACRs 7 year The computation of depreciation for 12 year is as follows Year Depreciati... View full answer

Get step-by-step solutions from verified subject matter experts