Question: A car manufacturer changed its financial reporting inventory method from LIFO to FIFO. The manufacturer explained in a letter to shareholders that other automobile

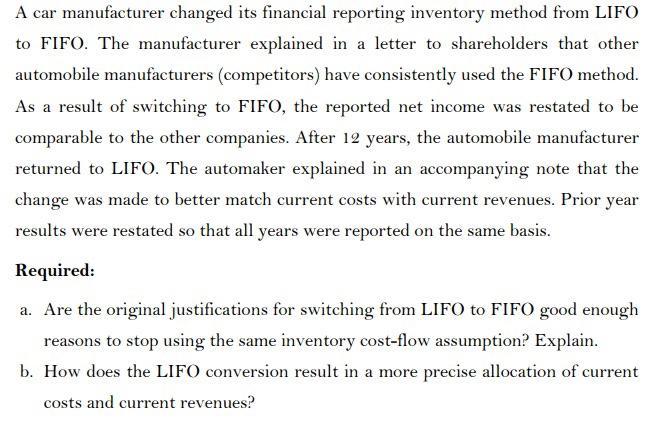

A car manufacturer changed its financial reporting inventory method from LIFO to FIFO. The manufacturer explained in a letter to shareholders that other automobile manufacturers (competitors) have consistently used the FIFO method. As a result of switching to FIFO, the reported net income was restated to be comparable to the other companies. After 12 years, the automobile manufacturer returned to LIFO. The automaker explained in an accompanying note that the change was made to better match current costs with current revenues. Prior year results were restated so that all years were reported on the same basis. Required: a. Are the original justifications for switching from LIFO to FIFO good enough reasons to stop using the same inventory cost-flow assumption? Explain. b. How does the LIFO conversion result in a more precise allocation of current costs and current revenues?

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Are the original justifications for switching from LIFO to FIFO good enough reasons to stop using th... View full answer

Get step-by-step solutions from verified subject matter experts