Question: A case of a decision problem under uncertainty While El Nio is pouring its rain on northern California, Katherine Rothstein, CEO, major shareholder and founder

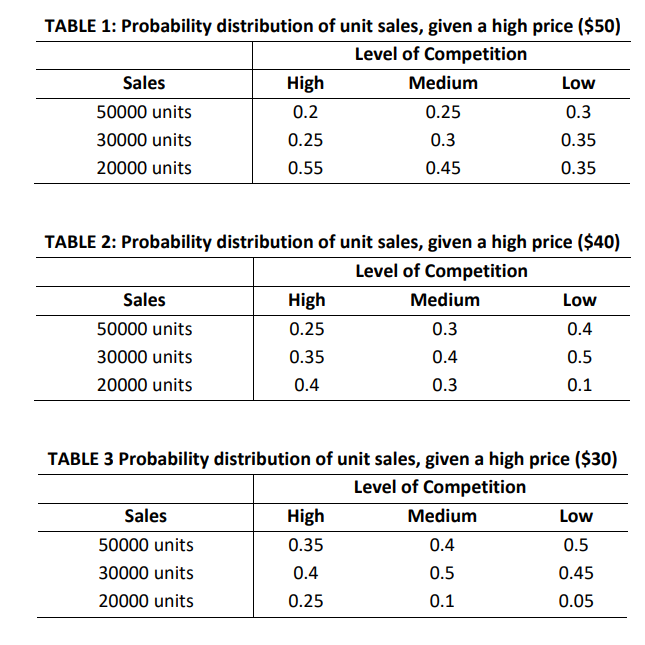

A case of a decision problem under uncertainty While El Nio is pouring its rain on northern California, Katherine Rothstein, CEO, major shareholder and founder of Brainsoft, sits in her office, contemplating the decision she faces regarding her companys newest proposed product, Brainet. This has been a particularly difficult decision. Brainet might catch on and sell very well. However, Katherine is concerned about the risk involved. In this competitive market, marketing Brainet also could lead to substantial losses. Should she go ahead anyway and start the marketing campaign? Or just abandon the product? Or perhaps buy additional marketing research information from a local market research company before deciding whether to launch the product? She must make a decision very soon and so, as she slowly drinks from her glass of high protein-power multivitamin juice, she reflects on the events of the past few years. Brainsoft was founded by Katherine and two friends after they had graduated from business school. The company is in the heart of Silicon Valley. Katherine and her friends managed to make money in their second year in business and continued to do so every year since. Brainsoft was one of the first companies to sell software over the World Wide Web and to develop PC-based software tools for the multimedia sector. Two of the products generate 80 percent of the companys revenues: Audiatur and Videatur. Each product has sold more than 100,000 units during the past year. Business is done over the Web: customers can download a trial version of the software, test it, and if they are satisfied with what they see, they can purchase the product (by using a password that enables them to disable the time counter in the trial version). Both products are priced at $75.95 and are exclusively sold over the Web. Although the World Wide Web is a network of computers of different types, running different kinds of software, a standardized protocol between the computers enables them to communicate. Users can surf the Web and visit computers many thousand miles away, accessing information available at the site. Users can also make files available on the Web, and this is how Brainsoft generates its sales. Selling software over the Web eliminates many of the traditional cost factors of consumer products: packaging, storage, distribution, sales force, etc. Instead, potential customers can download a trial version, look at it (that is, use the product) before its trial period expires, and then decide whether to buy it. Furthermore, Brainsoft can always make the most recent files available to the customer, avoiding the problem of having outdated software in the distribution pipeline. Katherine is interrupted in her thoughts by the arrival of Jeannie Korn. Jeannie oversees marketing for on-line products and Brainet has had her particular attention from the beginning. She is more than ready to provide the advice that Katherine has requested. Katherine, I think we should really go ahead with Brainet. The software engineers have convinced me that the current version is robust, and we want to be on the market with this as soon as possible! From the data for our product launches during the past two years we can get a rather reliable estimate of how the market will respond to the new product, dont you think? And look! She pulls out some presentation slides. During that time-period we launched 12 new products altogether and 4 of them sold more than 30,000 units during the first 6 months alone! Even better: the last two we launched even sold more than 40,000 copies during the first two quarters! Katherine knows these numbers as well as Jeannie does. After all, two of these launches have been products she herself helped to develop. But she feels uneasy about this particular product launch. The company has grown rapidly during the past three years and its financial capabilities are already rather stretched. A poor product launch for Brainet would cost the company a lot of money, something that isnt available right now due to the investments Brainsoft has recently made. Later in the afternoon, Katherine meets with Reggie Ruffin, a jack-of-all-trades and the production manager. Reggie has a solid track record in his field and Katherine wants his opinion on the Brainet project. Well, Katherine, quite frankly I think that there are three main factors that are relevant to the success of this project: competition, units sold, and costah, and of course our pricing. Have you decided on the price yet? I am still considering which of the three strategies would be most beneficial to us. Selling for $50.00 and trying to maximize revenuesor selling for $30.00 and trying to maximize market share. Of course, there is still your third alternative; we could sell for $40.00 and try to do both. At this point Reggie focuses on the sheet of paper in front of him. And I still believe that the $40.00 alternative is the best one. Concerning the costs, I checked the records; basically, we must amortize the development costs we incurred for Brainet. So far we have spent $800,000 and we expect to spend another $50,000 per year for support and shipping the CDs to those who want a hardcopy on top of their downloaded software. Reggie next hands a report to Katherine. Here we have some data on the industry. I just received that yesterday, hot off the press. Let us see what we can learn about the industry here. He shows Katherine some of the highlights. Reggie then agrees to compile the most relevant information contained in the report and have it ready for Katherine the following morning. It takes him long into the night to gather the data from the pages of the report, but in the end, he produces three tables, one for each of the three alternative pricing strategies. Each table shows the corresponding probability of various amounts of sales given the level of competition (high, medium, or low) that develops from other companies. The next morning Katherine is sipping from another power drink. Jeannie and Reggie will be in her office any moment now and, with their help, she will have to decide what to do with Brainet. Should they launch the product? If so, at what price?

When Jeannie and Reggie enter the office, Jeannie immediately bursts out: Guys, I just spoke to our marketing research company. They say that they could do a study for us about the competitive situation for the introduction of Brainet and deliver the results within a week. How much do they want for the study? I knew youd ask that, Reggie. They want $10,000 and I think its a fair deal. At this point Katherine steps into the conversation. Do we have any data on the quality of the work of this marketing research company? Yes, I do have some reports here. After analyzing them, I have come to the conclusion that the marketing research company is not very good in predicting the competitive environment for medium or low pricing. Therefore, we should not ask them to do the study for us if we decide on one of these two pricing strategies. However, in the case of high pricing, they do quite well: given that the competition turned out to be high, they predicted it correctly 80 percent of the time, while 15 percent of the time they predicted medium competition in that setting. Given that the competition turned out to be medium, they predicted high competition 15 percent of the time and medium competition 80 percent of the time. Finally, for the case of low competition, the numbers were 90 percent of the time a correct prediction, 7 percent of the time a medium prediction and 3 percent of the time a high prediction. Katherine feels that all these numbers are too much for her. Dont we have a simple estimate of how the market will react? Some prior probabilities, you mean. Sure, from our experience, the likelihood of facing high competition is 20 percent, whereas it is 70 percent for medium competition and 10 percent for low competition, Jeannie has her numbers always ready when needed. Analyze the above case of a decision problem under uncertainty and help Katherine answer the following questions:

a) For the initial analysis, ignore the opportunity of obtaining more information by hiring the marketing research company. Then formulate the decision problem in a decision tree. Clearly distinguish between decision and chance forks and include all the relevant data. What decision will you recommend for maximizing the expected revenue? Give appropriate reasons.

b) Now consider the possibility of doing the market research. Develop the corresponding decision tree. Calculate the relevant probabilities and analyze the decision tree. Should Brainsoft pay $10,000 for the marketing research? Give appropriate reasons

TABLE 1: Probability distribution of unit sales, given a high price ($50) Level of Competition Sales High Medium Low 50000 units 0.2 0.25 0.3 30000 units 0.25 0.3 0.35 20000 units 0.55 0.45 0.35 TABLE 2: Probability distribution of unit sales, given a high price ($40) Level of Competition Sales High Medium Low 50000 units 0.25 0.3 0.4 30000 units 0.35 0.4 0.5 20000 units 0.4 0.3 0.1 TABLE 3 Probability distribution of unit sales, given a high price ($30) Level of Competition Sales High Medium Low 50000 units 0.35 0.4 0.5 30000 units 0.4 0.5 0.45 20000 units 0.25 0.1 0.05Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts