Question: A cash generating unit (CGU) comprising a factory, plant and equipment etc and associated purchased goodwill becomes impaired because the product it makes is overtaken

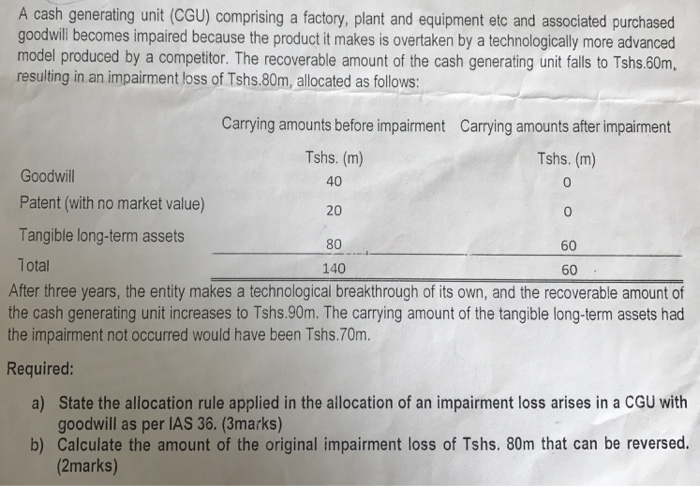

A cash generating unit (CGU) comprising a factory, plant and equipment etc and associated purchased goodwill becomes impaired because the product it makes is overtaken by a technologically more advanced model produced by a competitor. The recoverable amount of the cash generating unit falls to Tshs.60m, resulting in an impairment loss of Tshs.80m, allocated as follows Carrying amounts before impairment Carrying amounts after impairment Goodwil Patent (with no market value) Tangible long-term assets 1otal Tshs. (m) 40 20 80 140 Tshs. (m) 0 0 60 60 After three years, the entity makes a technological breakthrough of its own, and the recoverable amount of the cash generating unit increases to Tshs.90m. The carrying amount of the tangible long-term assets had the impairment not occurred would have been Tshs.70m Required: State the allocation rule applied in the allocation of an impairment loss arises in a CGU with goodwill as per IAS 36. (3marks) a) b) Calculate the amount of the original impairment loss of Tshs. 80m that can be reversed. (2marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts