Question: A cash-flow budget uses the same format as a cash-flow statement. It is prepared on a monthly basis and it reflects budgeted income and expenses,

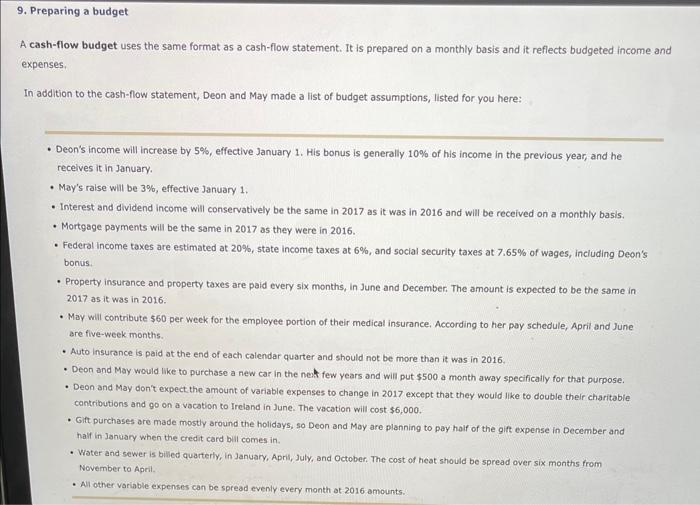

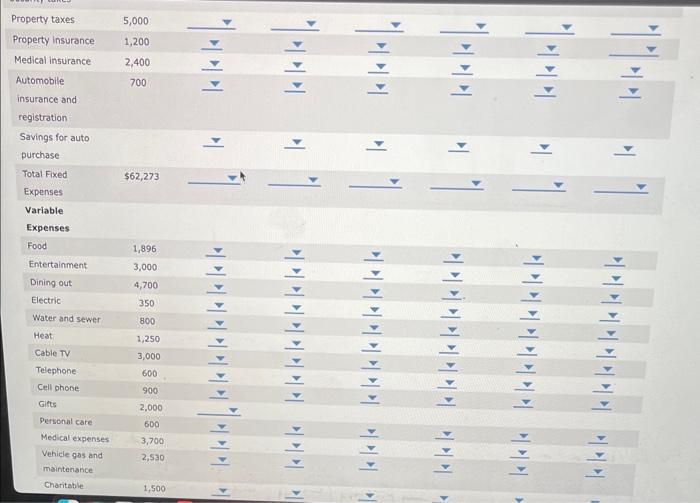

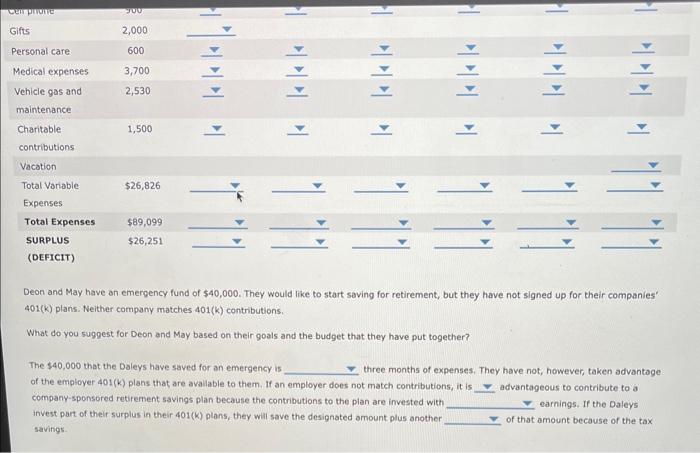

A cash-flow budget uses the same format as a cash-flow statement. It is prepared on a monthly basis and it reflects budgeted income and expenses, In addition to the cash-flow statement, Deon and May made a list of budget assumptions, listed for you here: - Deon's income will increase by 5%, effective January 1. His bonus is generally 10% of his income in the previous year, and he recelves it in January. - May's raise will be 3%, effective January 1. - Interest and dividend income will conservatively be the same in 2017 as it was in 2016 and will be received on a monthly basis. - Mortgage payments will be the same in 2017 as they were in 2016. - Federal income taxes are estimated at 20%, state income taxes at 6%, and social security taxes at 7.65% of wages, including Deon's bonus. - Property insurance and property taxes are paid every six months, in June and December. The amount is expected to be the same in 2017 as it was in 2016. - May will contribute $60 per week for the employee portion of their medical insurance. According to her pay schedule, April and June are five-week months. - Auto insurance is paid at the end of each calendar quarter and should not be more than it was in 2016. - Deon and May would like to purchase a new car in the neh few years and will put $500 a month away specifically for that purpose. - Deon and May don't expect the amount of variable expenses to change in 2017 except that they would like to double their charitable contributions and g0 on a vacation to Ireland in June. The vacation will cost $6,000. - Gift purchases are made mostly around the holidays, so Deon and May are planning to pay half of the gift expense in December and haif in January when the credit card bill comes in. - Water and sewer is bililed quarterly, in January, April, July, and October. The cost of heat should be spread over six months from November to April. - Al other variable expenses can be spread evenly every month at 2016 amounts. Annual Budget Name: Deon and Cash-Flow Fixed Expenses Mortgage Deon's federal income taxes Deon's state Deon's social security taxes May's federal income taxes May's state income taxes Mars socal Property taxes Deon and May have an emergency fund of $40,000. They would like to start saving for retirement, but they have not signed up for their companies' 401(k) plans. Neither company matches 401(k) contributions. What do you suggest for Deon and May based on their goals and the budget that they have put together? The $40,000 that the Daleys have saved for an emergency is three months of expenses. They have not, however, taken advantage of the employer 401(k) plans that are avaliable to them. If an employer does not match contributions, it is company-sponsored retirement savings plan because the contributions to the plan are invested with advantageous to contribute to a invest part of their surplus in their 401(K) plans, they will save the designated armount plus another earnings. If the Daleys savings. of that amount because of the tax A cash-flow budget uses the same format as a cash-flow statement. It is prepared on a monthly basis and it reflects budgeted income and expenses, In addition to the cash-flow statement, Deon and May made a list of budget assumptions, listed for you here: - Deon's income will increase by 5%, effective January 1. His bonus is generally 10% of his income in the previous year, and he recelves it in January. - May's raise will be 3%, effective January 1. - Interest and dividend income will conservatively be the same in 2017 as it was in 2016 and will be received on a monthly basis. - Mortgage payments will be the same in 2017 as they were in 2016. - Federal income taxes are estimated at 20%, state income taxes at 6%, and social security taxes at 7.65% of wages, including Deon's bonus. - Property insurance and property taxes are paid every six months, in June and December. The amount is expected to be the same in 2017 as it was in 2016. - May will contribute $60 per week for the employee portion of their medical insurance. According to her pay schedule, April and June are five-week months. - Auto insurance is paid at the end of each calendar quarter and should not be more than it was in 2016. - Deon and May would like to purchase a new car in the neh few years and will put $500 a month away specifically for that purpose. - Deon and May don't expect the amount of variable expenses to change in 2017 except that they would like to double their charitable contributions and g0 on a vacation to Ireland in June. The vacation will cost $6,000. - Gift purchases are made mostly around the holidays, so Deon and May are planning to pay half of the gift expense in December and haif in January when the credit card bill comes in. - Water and sewer is bililed quarterly, in January, April, July, and October. The cost of heat should be spread over six months from November to April. - Al other variable expenses can be spread evenly every month at 2016 amounts. Annual Budget Name: Deon and Cash-Flow Fixed Expenses Mortgage Deon's federal income taxes Deon's state Deon's social security taxes May's federal income taxes May's state income taxes Mars socal Property taxes Deon and May have an emergency fund of $40,000. They would like to start saving for retirement, but they have not signed up for their companies' 401(k) plans. Neither company matches 401(k) contributions. What do you suggest for Deon and May based on their goals and the budget that they have put together? The $40,000 that the Daleys have saved for an emergency is three months of expenses. They have not, however, taken advantage of the employer 401(k) plans that are avaliable to them. If an employer does not match contributions, it is company-sponsored retirement savings plan because the contributions to the plan are invested with advantageous to contribute to a invest part of their surplus in their 401(K) plans, they will save the designated armount plus another earnings. If the Daleys savings. of that amount because of the tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts