Question: A certain commodity, which we call corn, is grown by many farmers, but the amount of corn harvested by every farmer depends on the weather:

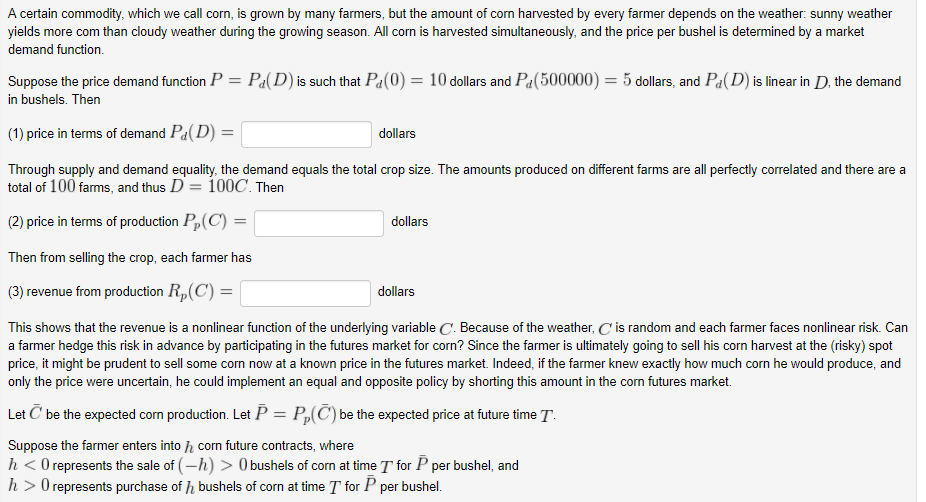

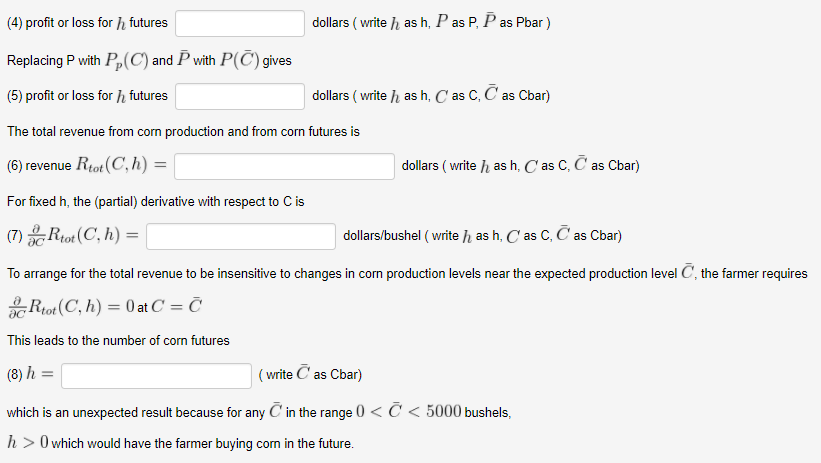

A certain commodity, which we call corn, is grown by many farmers, but the amount of corn harvested by every farmer depends on the weather: sunny weather yields more com than cloudy weather during the growing season. All corn is harvested simultaneously, and the price per bushel is determined by a market demand function Suppose the price demand function P = P(D) is such that Pl(0) = 10 dollars and Pal 500000) = 5 dollars, and PI(D) is linear in D the demand in bushels. Then (1) price in terms of demand PaD) dollars Through supply and demand equality, the demand equals the total crop size. The amounts produced on different farms are all perfectly correlated and there are a total of 100 farms, and thus D-100C. Then (2) price in terms of production P,(C) Then from selling the crop, each farmer has (3) revenue from production ,(C) = dollars dollars This shows that the revenue is a nonlinear function of the underlying variable C. Because of the weather, C is random and each farmer faces nonlinear risk. Carn a farmer hedge this risk in advance by participating in the futures market for corn? Since the farmer is ultimately going to sell his corn harvest at the (risky) spot price, it might be prudent to sell some corn now at a known price in the futures market. Indeed, if the farmer knew exactly how much corn he would produce, and only the price were uncertain, he could implement an equal and opposite policy by shorting this amount in the corn futures market. Let C be the expected corn production. Let P = P (C) be the expected price at future time T Suppose the farmer enters into h corn future contracts, where h 0bushels of corm at time T for P per bushel, and h0 represents purchase of h bushels of corn at time T for P per bushel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts