Question: A chemical plant is considering purchasing a computerized control system. The initial cost is $ 2 0 0 , 0 0 0 , and the

A chemical plant is considering purchasing a computerized control system. The initial cost

is $ and the system will produce net savings of $ per year. If purchased, the

system will be depreciated under MACRS as a fiveyear recovery property. The system will

be used for four years, at the end of which time the firm expects to sell it for $ The

firm's marginal tax rate on this investment is Any capital gains will be taxed at the

same income tax rate. The firm is considering purchasing the computer control system

either through its retained earnings or through borrowing from a local bank. Two

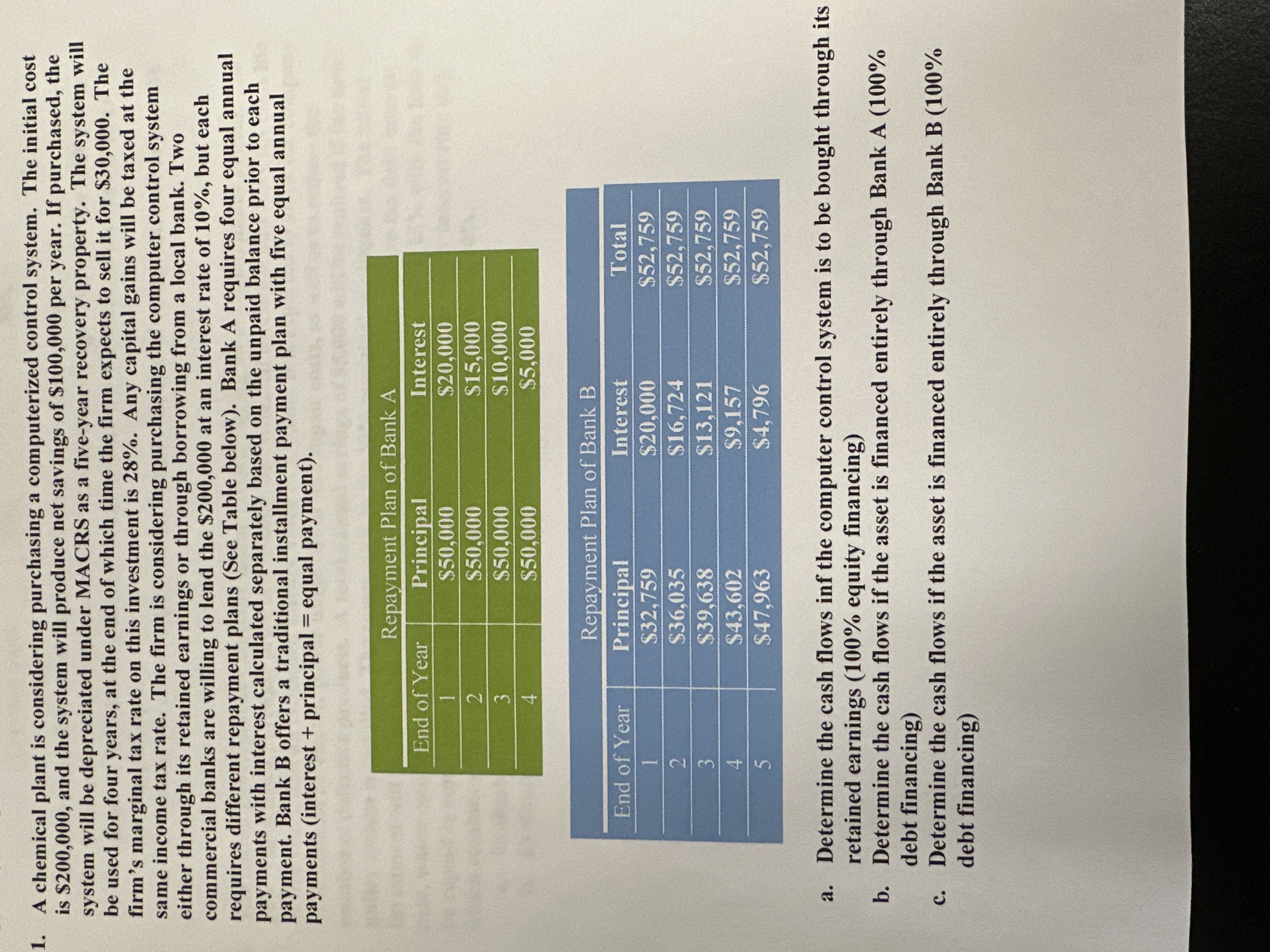

commercial banks are willing to lend the $ at an interest rate of but each

requires different repayment plans See Table below Bank A requires four equal annual

payments with interest calculated separately based on the unpaid balance prior to each

payment. Bank B offers a traditional installment payment plan with five equal annual

payments interest principal equal payment

a Determine the cash flows inf the computer control system is to be bought through its

retained earnings equity financing

b Determine the cash flows if the asset is financed entirely through Bank

debt financing

c Determine the cash flows if the asset is financed entirely through Bank B

debt financing

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock