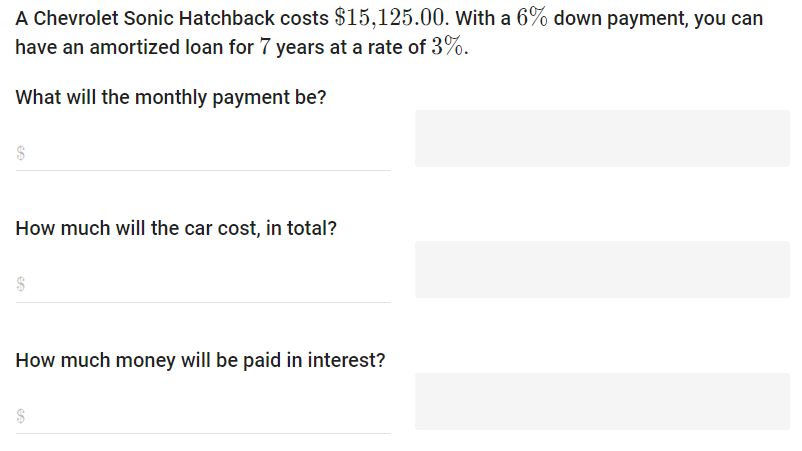

Question: A Chevrolet Sonic Hatchback costs $15,125.00. With a 6% down payment, you can have an amortized loan for 7 years at a rate of

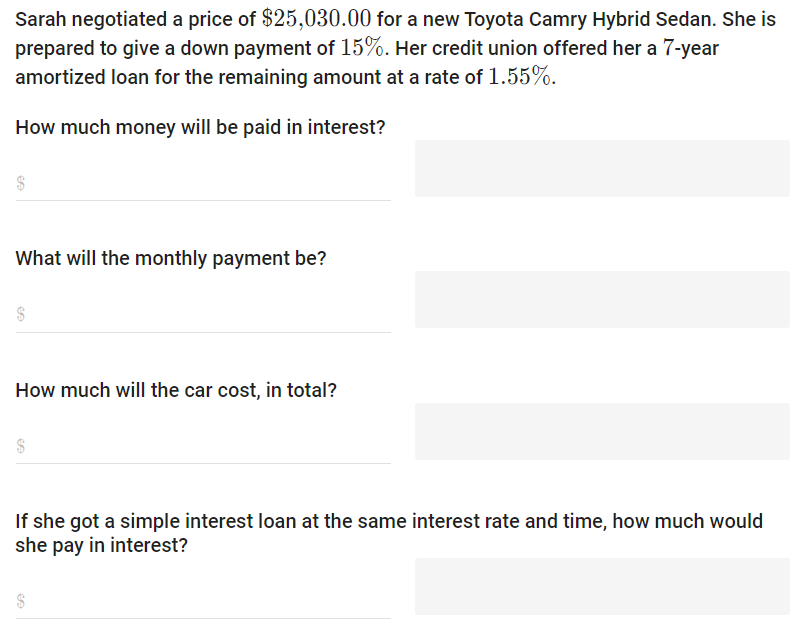

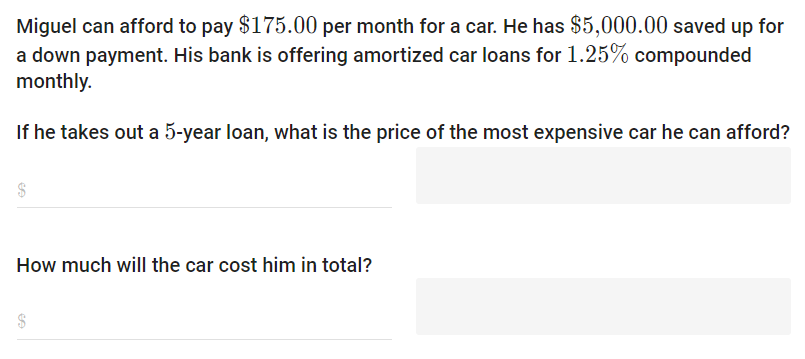

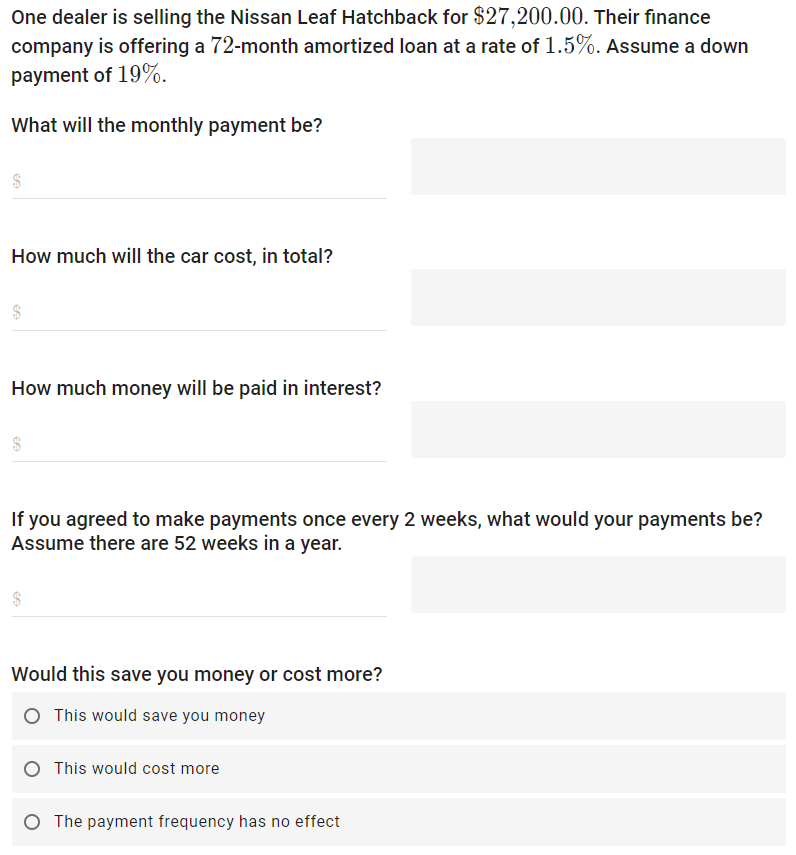

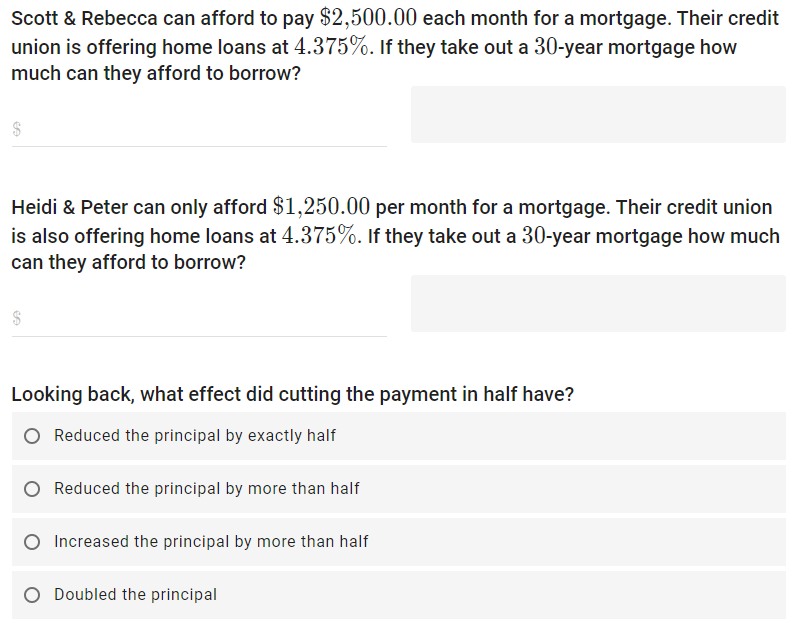

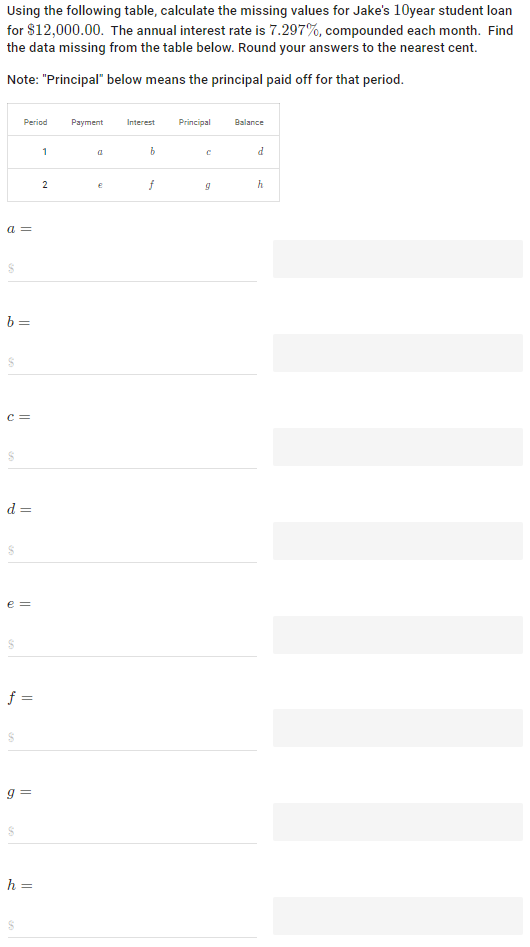

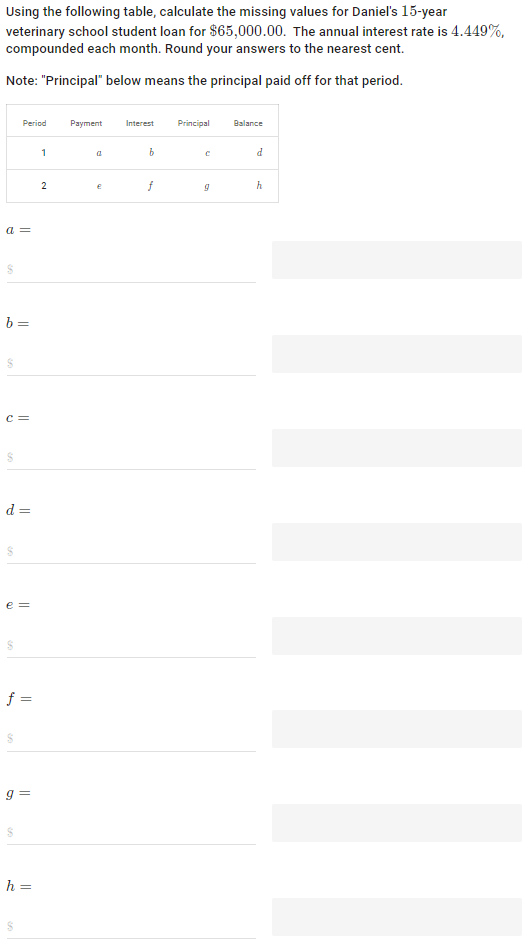

A Chevrolet Sonic Hatchback costs $15,125.00. With a 6% down payment, you can have an amortized loan for 7 years at a rate of 3%. What will the monthly payment be? S How much will the car cost, in total? $ How much money will be paid in interest? e Sarah negotiated a price of $25,030.00 for a new Toyota Camry Hybrid Sedan. She is prepared to give a down payment of 15%. Her credit union offered her a 7-year amortized loan for the remaining amount at a rate of 1.55%. How much money will be paid in interest? SA What will the monthly payment be? SA How much will the car cost, in total? If she got a simple interest loan at the same interest rate and time, how much would she pay in interest? GA Miguel can afford to pay $175.00 per month for a car. He has $5,000.00 saved up for a down payment. His bank is offering amortized car loans for 1.25% compounded monthly. If he takes out a 5-year loan, what is the price of the most expensive car he can afford? How much will the car cost him in total? One dealer is selling the Nissan Leaf Hatchback for $27,200.00. Their finance company is offering a 72-month amortized loan at a rate of 1.5%. Assume a down payment of 19%. What will the monthly payment be? $ How much will the car cost, in total? How much money will be paid in interest? EA If you agreed to make payments once every 2 weeks, what would your payments be? Assume there are 52 weeks in a year. $ Would this save you money or cost more? O This would save you money This would cost more The payment frequency has no effect Scott & Rebecca can afford to pay $2,500.00 each month for a mortgage. Their credit union is offering home loans at 4.375%. If they take out a 30-year mortgage how much can they afford to borrow? Heidi & Peter can only afford $1,250.00 per month for a mortgage. Their credit union is also offering home loans at 4.375%. If they take out a 30-year mortgage how much can they afford to borrow? Looking back, what effect did cutting the payment in half have? O Reduced the principal by exactly half Reduced the principal by more than half Increased the principal by more than half O Doubled the principal Using the following table, calculate the missing values for Jake's 10year student loan for $12,000.00. The annual interest rate is 7.297%, compounded each month. Find the data missing from the table below. Round your answers to the nearest cent. Note: "Principal" below means the principal paid off for that period. a = $ b = Period C= d= $ e = f = $ g= $ h = 1 2 Payment Interest b f Principal C 9 Balance d h Using the following table, calculate the missing values for Daniel's 15-year veterinary school student loan for $65,000.00. The annual interest rate is 4.449%, compounded each month. Round your answers to the nearest cent. Note: "Principal" below means the principal paid off for that period. a = $ b= $ C = $ Period d = $ e = $ f = g= $ h = $ 1 2 Payment Interest a b f Principal 9 Balance d h

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

To calculate the monthly payment for an amortized loan we can use the formula P r A1 1 ... View full answer

Get step-by-step solutions from verified subject matter experts