Question: A city analyst has told you that this security closely follows the market, but that it is no more risky, on average, than the market.

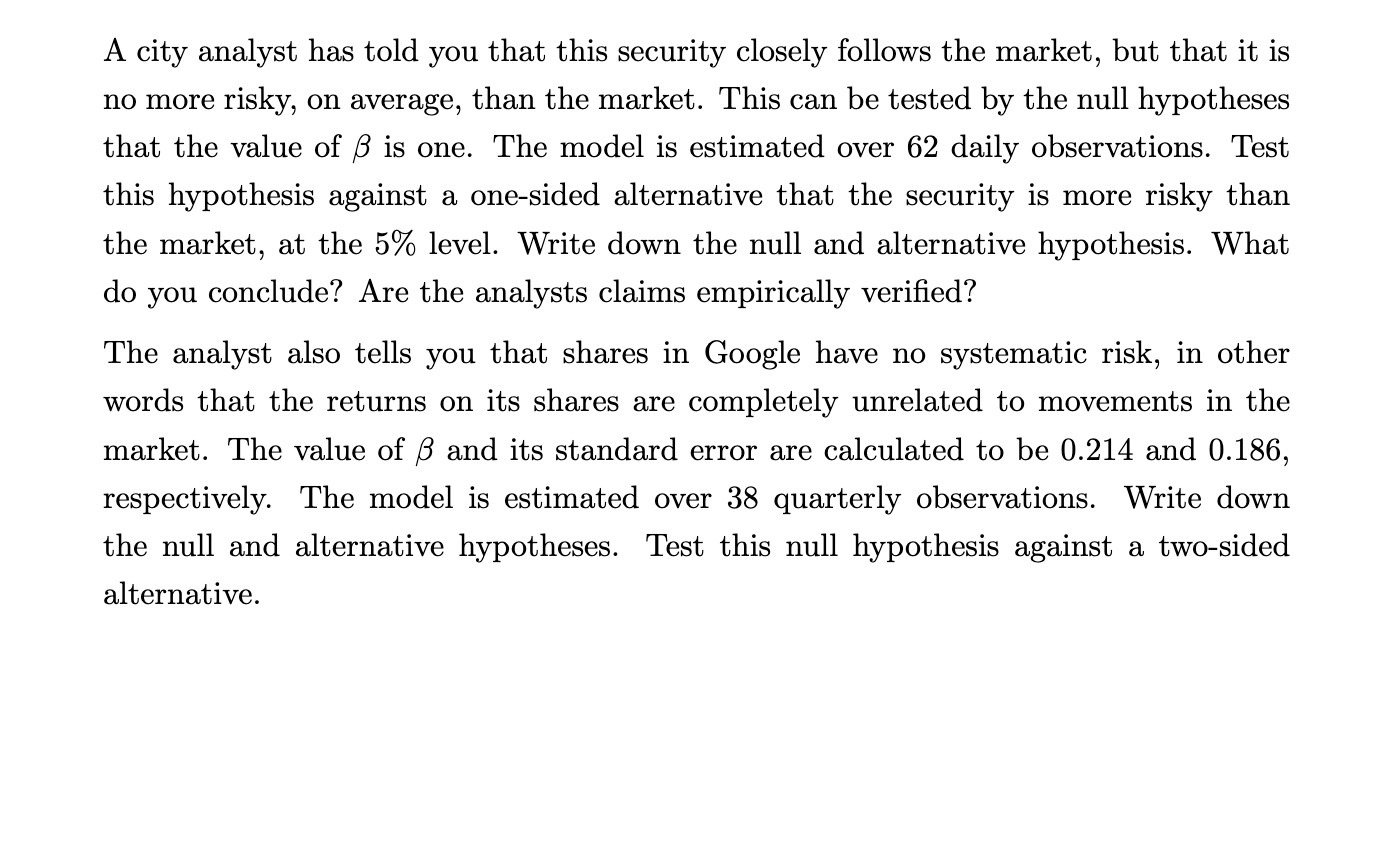

A city analyst has told you that this security closely follows the market, but that it is no more risky, on average, than the market. This can be tested by the null hypotheses that the value of 13 is one. The model is estimated over 62 daily observations. Test this hypothesis against a one-sided alternative that the security is more risky than the market, at the 5% level. Write down the null and alternative hypothesis. What do you conclude? Are the analysts claims empirically veried? The analyst also tells you that shares in Google have no systematic risk, in other words that the returns on its shares are completely unrelated to movements in the market. The value of B and its standard error are calculated to be 0.214 and 0.186, respectively. The model is estimated over 38 quarterly observations. Write down the null and alternative hypotheses. Test this null hypothesis against a twosided alternative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts