Question: A city is considering building a stadium that will raise local businesses' profits by attracting outsiders who will spend more locally (buying goods and services

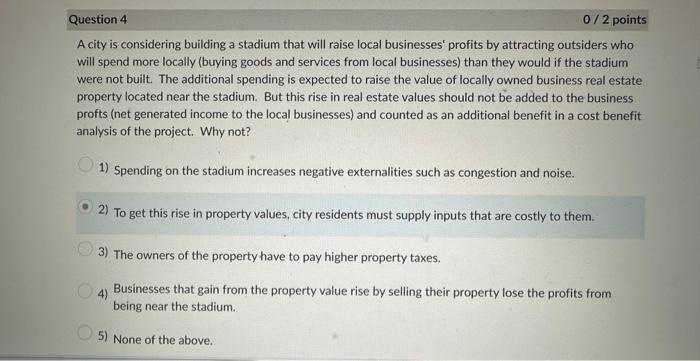

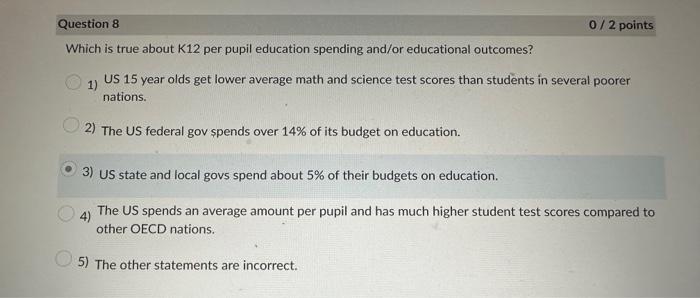

A city is considering building a stadium that will raise local businesses' profits by attracting outsiders who will spend more locally (buying goods and services from local businesses) than they would if the stadium were not built. The additional spending is expected to raise the value of locally owned business real estate property located near the stadium. But this rise in real estate values should not be added to the business profts (net generated income to the local businesses) and counted as an additional benefit in a cost benefit analysis of the project. Why not? 1) Spending on the stadium increases negative externalities such as congestion and noise. 2) To get this rise in property values, city residents must supply inputs that are costly to them. 3) The owners of the property have to pay higher property taxes. 4) Businesses that gain from the property value rise by selling their property lose the profits from being near the stadium. 5) None of the above. About what fraction of US K12 students attend public schools? 1) 10% 2) 30% 3) 60% 4) 90% Which is true about K12 per pupil education spending and/or educational outcomes? 1) US 15 year olds get lower average math and science test scores than students in several poorer nations. 2) The US federal gov spends over 14% of its budget on education. 3) US state and local govs spend about 5% of their budgets on education. 4) The US spends an average amount per pupil and has much higher student test scores compared to other OECD nations. 5) The other statements are incorrect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts