Question: A clear and short answer, please Problem Set 5 Problems 1. What characteristics define the money markets? 2. Why do banks not eliminate the need

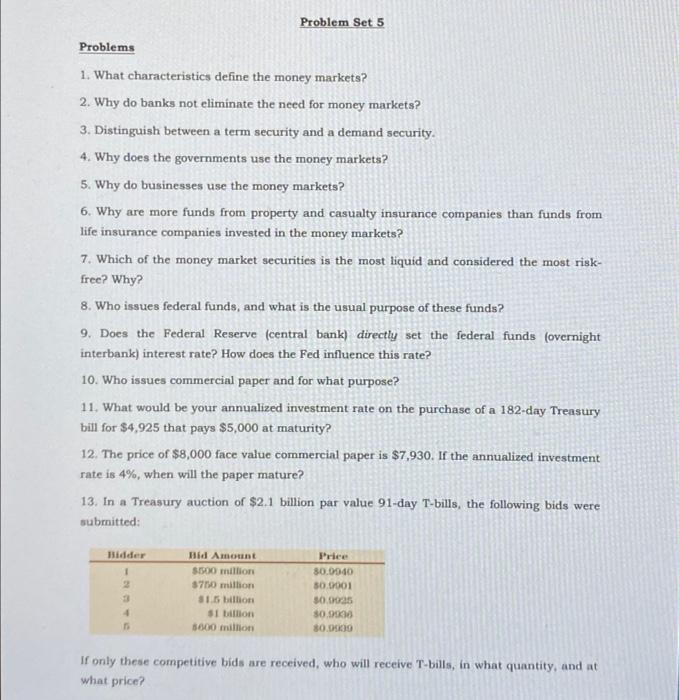

Problem Set 5 Problems 1. What characteristics define the money markets? 2. Why do banks not eliminate the need for money markets? 3. Distinguish between a term security and a demand security. 4. Why does the governments use the money markets? 5. Why do businesses use the money markets? 6. Why are more funds from property and casualty insurance companies than funds from life insurance companies invested in the money markets? 7. Which of the money market securities is the most liquid and considered the most risk- free? Why? 8. Who issues federal funds, and what is the usual purpose of these funds? 9. Does the Federal Reserve (central bank) directly set the federal funds (overnight interbank) interest rate? How does the Fed influence this rate? 10. Who issues commercial paper and for what purpose? 11. What would be your annualized investment rate on the purchase of a 182-day Treasury bill for $4,925 that pays $5,000 at maturity? 12. The price of $8,000 face value commercial paper is $7,930. If the annualized investment rate is 4%, when will the paper mature? 13. In a Treasury auction of $2.1 billion par value 91-day T-bills, the following bids were submitted: Hidder 1 2 3 Bid Amount SISOO million $700 million SIS on Si on 3600 million Price 30.0940 50.0001 30.035 30.9 30.DKO If only these competitive bids are received, who will receive T-bills, in what quantity, and at what price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts