Question: A client aged 40 is making some financial arrangements for his retirement and his son's college expenses. Together with the tuition and living expenditure, the

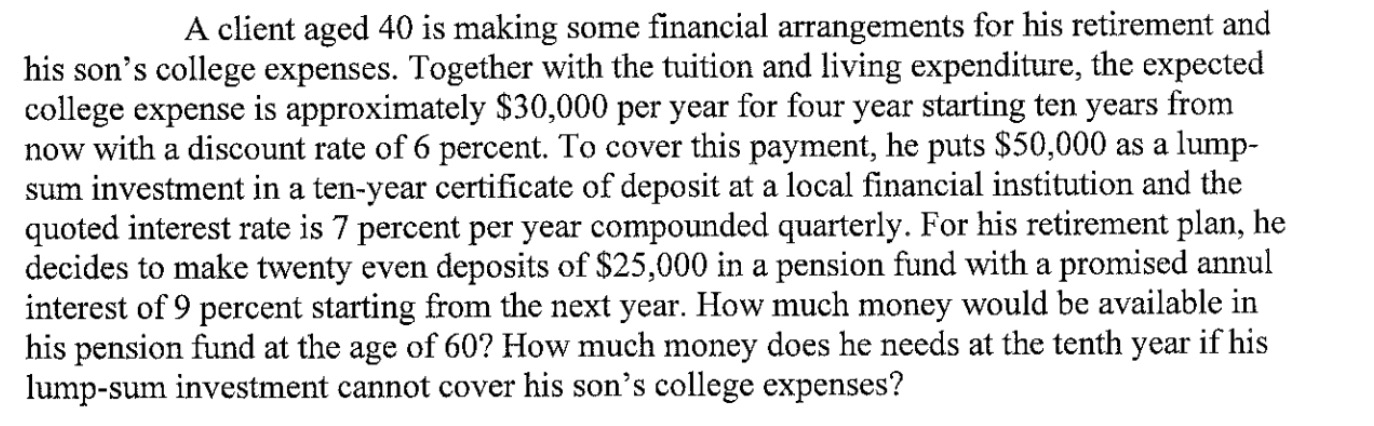

A client aged 40 is making some financial arrangements for his retirement and his son's college expenses. Together with the tuition and living expenditure, the expected college expense is approximately $30,000 per year for four year starting ten years from now with a discount rate of 6 percent. To cover this payment, he puts $50,000 as a lumpsum investment in a ten-year certificate of deposit at a local financial institution and the quoted interest rate is 7 percent per year compounded quarterly. For his retirement plan, he decides to make twenty even deposits of $25,000 in a pension fund with a promised annul interest of 9 percent starting from the next year. How much money would be available in his pension fund at the age of 60 ? How much money does he needs at the tenth year if his lump-sum investment cannot cover his son's college expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts