Question: A client asks Lara, a tax practitioner, to provide tax advisory services. Which statement describes an activity that would illustrate the application of competence under

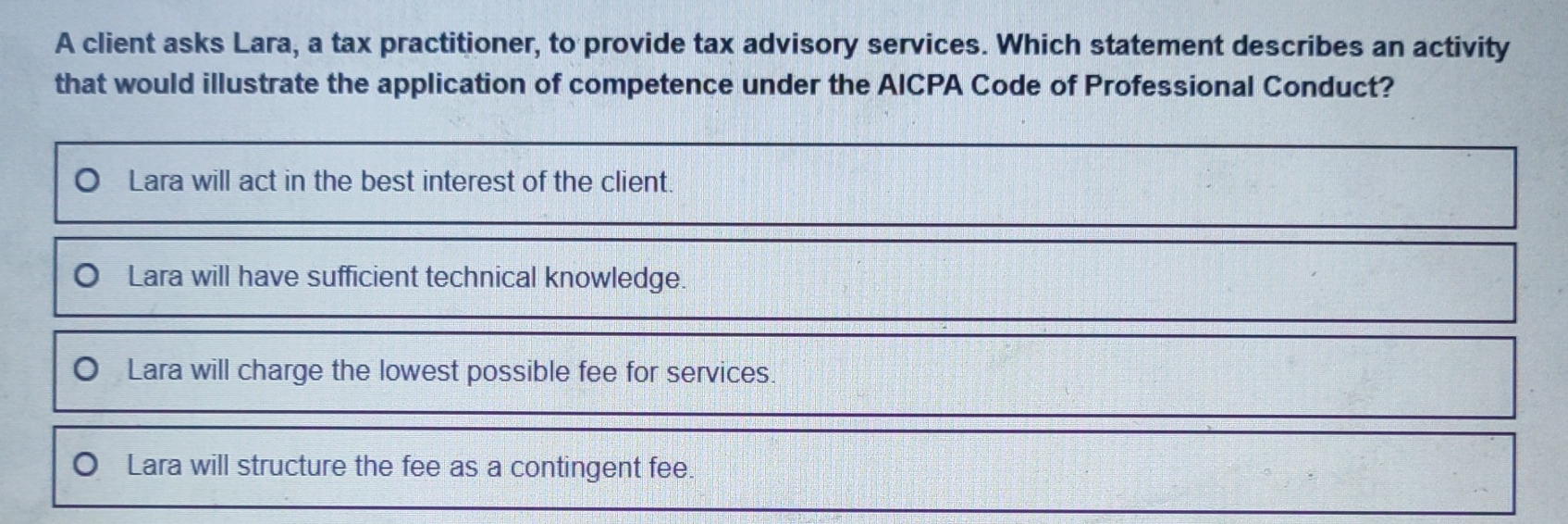

A client asks Lara, a tax practitioner, to provide tax advisory services. Which statement describes an activity

that would illustrate the application of competence under the AICPA Code of Professional Conduct?

Lara will act in the best interest of the client.

Lara will have sufficient technical knowledge.

Lara will charge the lowest possible fee for services.

Lara will structure the fee as a contingent fee.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock