Question: A client contacts you about changing from the cash method of accounting to the accrual method. Her questions specifically relate to accounts receivable and bad

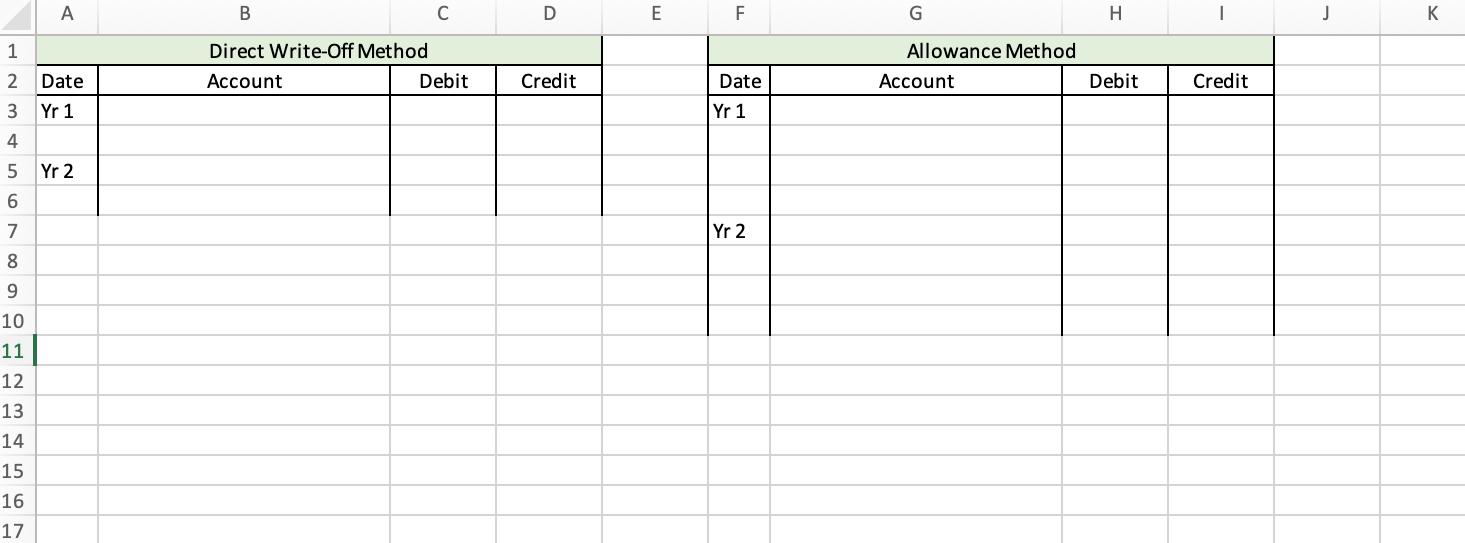

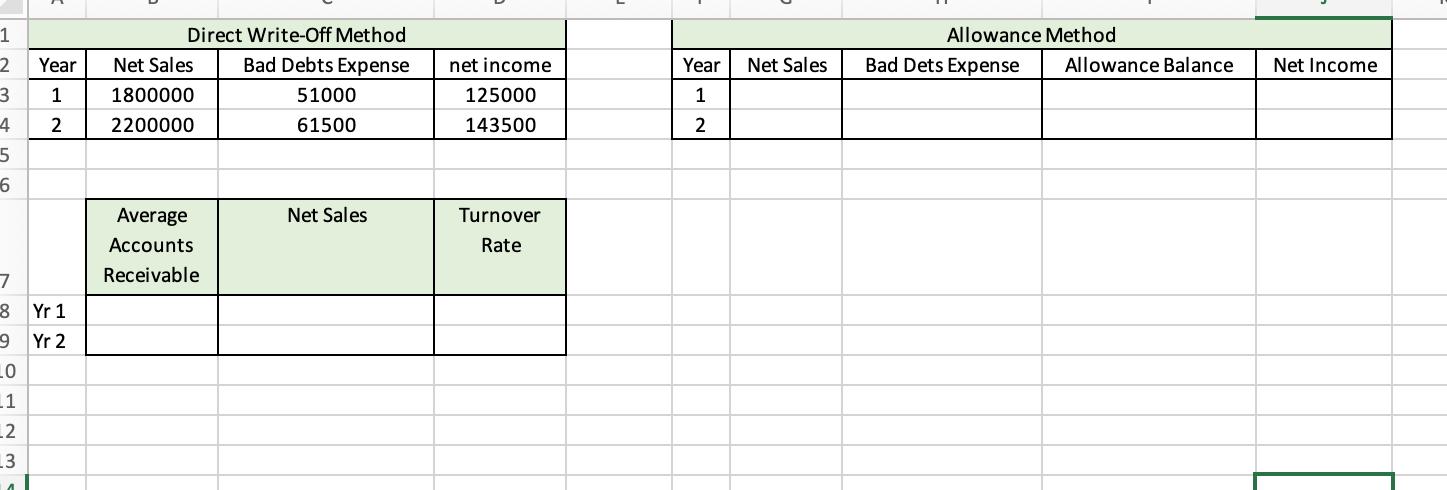

A client contacts you about changing from the cash method of accounting to the accrual method. Her questions specifically relate to accounts receivable and bad debts and notes receivable. During its first year of operations, the company had net sales of $1,800,000, wrote off $51,000 of account uncollectible using the direct write-off method, and reported net income of $125,000. During the second year of operations, the company had net sales of $2,200,000, wrote off $61,500 of accounts as uncollectible using the direct write-off method, and reported net income of $143,500. The company also has several short-term notes receivable from customers.

- Using the attached spreadsheet, calculate the net income for years one and two under the allowance method.

- Show the entries for both years that would need to be made under the allowance method and direct write-off method. Calculate the Accounts receivable turnover rate.

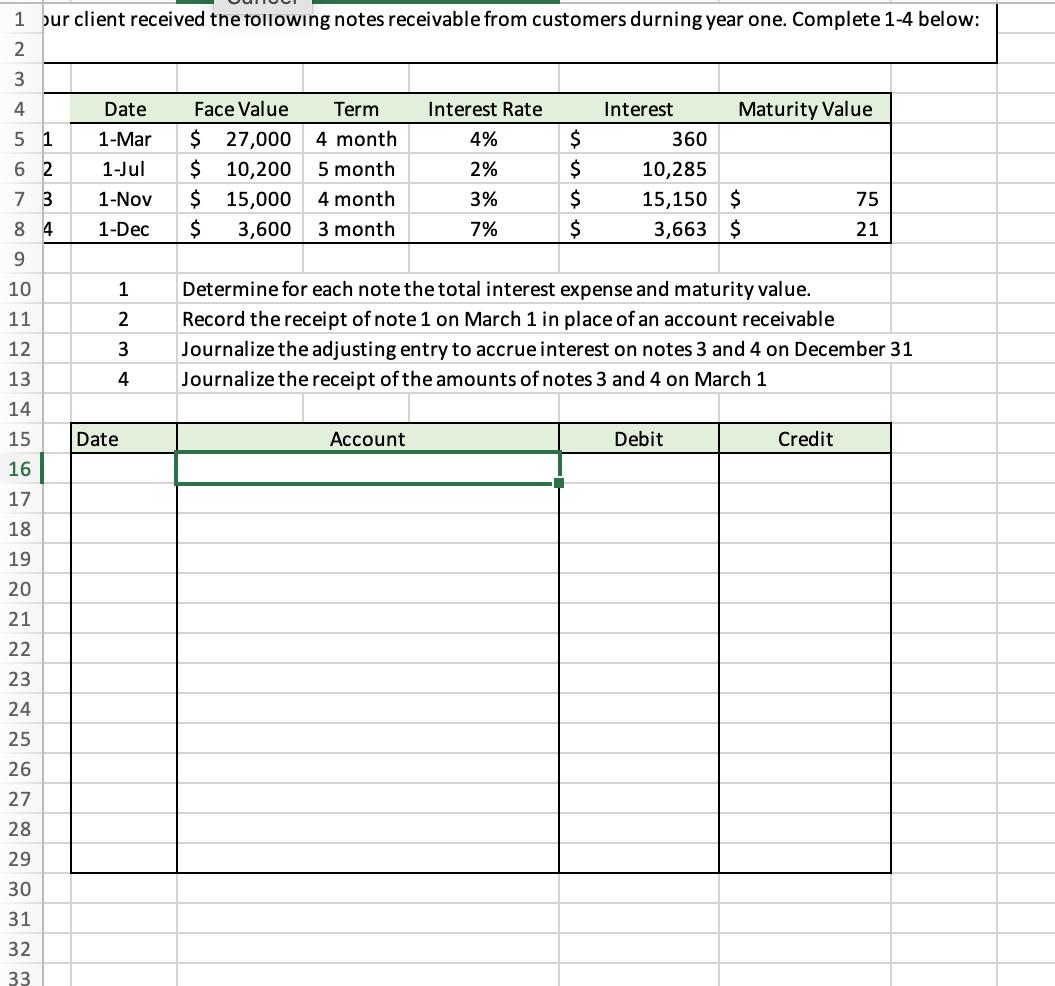

- Journalize the company's notes receivable.

1 our client received the following notes receivable from customers durning year one. Complete 1-4 below: 2 3 4 5 1 62 7 3 84 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 Date 1-Mar 1-Jul 1-Nov 1-Dec 1 2 3 4 Date Face Value Term $ 27,000 $ 10,200 $ 15,000 $ 3,600 4 month 5 month 4 month 3 month Interest Rate 4% 2% 3% 7% Account $ $ $ $ Interest Maturity Value 360 10,285 15,150 $ 3,663 $ Determine for each note the total interest expense and maturity value. Record the receipt of note 1 on March 1 in place of an account receivable Journalize the adjusting entry to accrue interest on notes 3 and 4 on December 31 Journalize the receipt of the amounts of notes 3 and 4 on March 1 Debit 75 21 Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts