Question: A client has $ 1 0 0 , 0 0 0 available to purchase an annuity. After completing a needs analysis, you recommend a variable

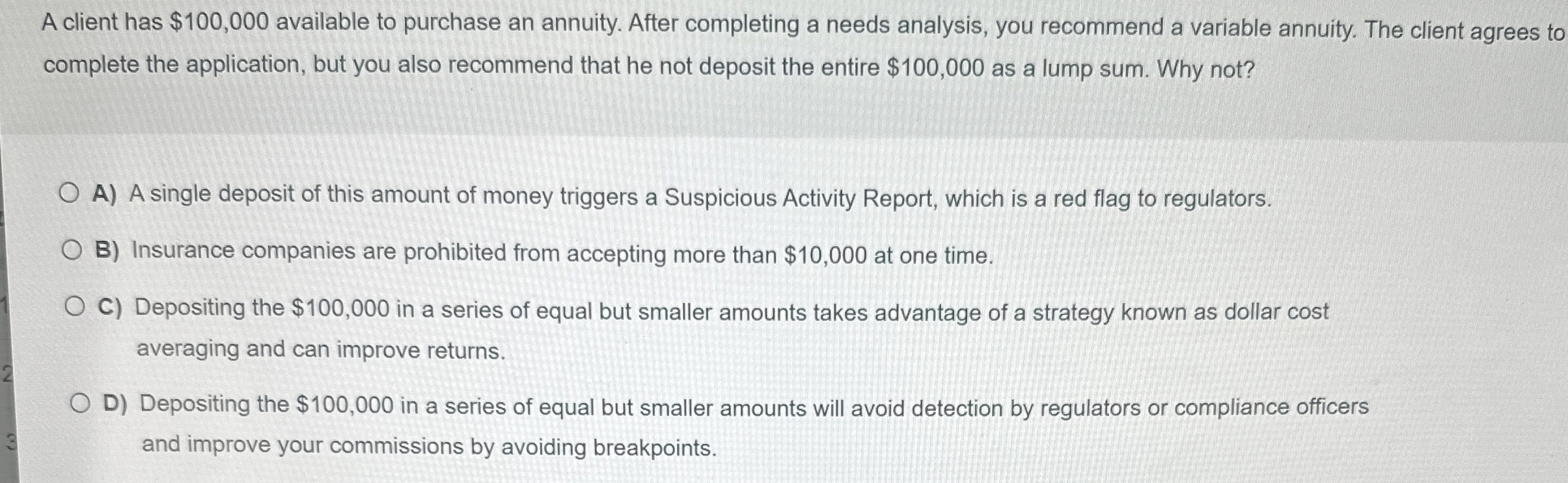

A client has $ available to purchase an annuity. After completing a needs analysis, you recommend a variable annuity. The client agrees to complete the application, but you also recommend that he not deposit the entire $ as a lump sum. Why not?

A A single deposit of this amount of money triggers a Suspicious Activity Report, which is a red flag to regulators.

B Insurance companies are prohibited from accepting more than $ at one time.

C Depositing the $ in a series of equal but smaller amounts takes advantage of a strategy known as dollar cost averaging and can improve returns.

D Depositing the $ in a series of equal but smaller amounts will avoid detection by regulators or compliance officers and improve your commissions by avoiding breakpoints.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock