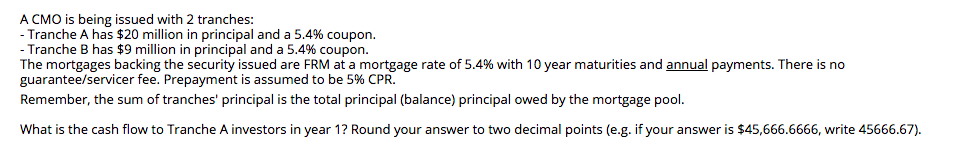

Question: A CMO is being issued with 2 tranches: - Tranche A has $20 million in principal and a 5.4% coupon. - Tranche B has $9

A CMO is being issued with 2 tranches: - Tranche A has $20 million in principal and a 5.4% coupon. - Tranche B has $9 million in principal and a 5.4% coupon. The mortgages backing the security issued are FRM at a mortgage rate of 5.4% with 10 year maturities and annual payments. There is no guarantee/servicer fee. Prepayment is assumed to be 5% CPR. Remember, the sum of tranches' principal is the total principal (balance) principal owed by the mortgage pool. What is the cash flow to Tranche A investors in year 12 Round your answer to two decimal points (e.g. if your answer is $45,666.6666, write 45666.67). A CMO is being issued with 2 tranches: - Tranche A has $20 million in principal and a 5.4% coupon. - Tranche B has $9 million in principal and a 5.4% coupon. The mortgages backing the security issued are FRM at a mortgage rate of 5.4% with 10 year maturities and annual payments. There is no guarantee/servicer fee. Prepayment is assumed to be 5% CPR. Remember, the sum of tranches' principal is the total principal (balance) principal owed by the mortgage pool. What is the cash flow to Tranche A investors in year 12 Round your answer to two decimal points (e.g. if your answer is $45,666.6666, write 45666.67)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts