Question: A collateralized mortgage obligation security (CMO) is writing upon a pool of mortgage loans with face value of $100 million and interest rate 10% per

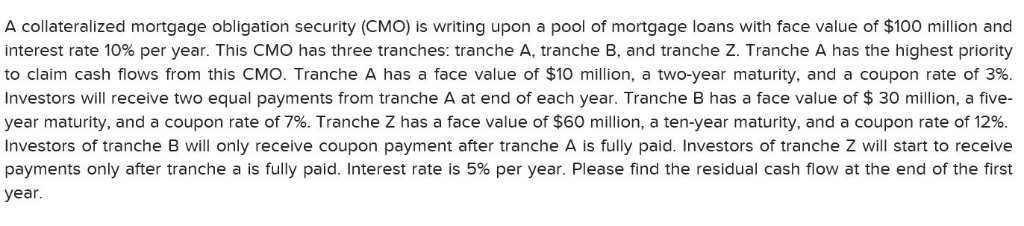

A collateralized mortgage obligation security (CMO) is writing upon a pool of mortgage loans with face value of $100 million and interest rate 10% per year. This CMO has three tranches: tranche A, tranche B, and tranche Z. Tranche A has the highest priority to claim cash flows from this CMO. Tranche A has a face value of $10 million, a two-year maturity, and a coupon rate of 3% Investors will receive two equal payments from tranche A at end of each year. Tranche B has a face value of $ 30 million, a five- year maturity, and a coupon rate of 7%. Tranche Z has a face value of $60 million, a ten-year maturity, and a coupon rate of 12% Investors of tranche B will only receive coupon payment after tranche A is fully paid. Investors of tranche Z will start to receive payments only after tranche a is fully paid. Interest rate is 5% per year. Please find the residual cash flow at the end of the first year Multiple Choice 3.12 million 2.72 million 1.21 million 0.75 million A collateralized mortgage obligation security (CMO) is writing upon a pool of mortgage loans with face value of $100 million and interest rate 10% per year. This CMO has three tranches: tranche A, tranche B, and tranche Z. Tranche A has the highest priority to claim cash flows from this CMO. Tranche A has a face value of $10 million, a two-year maturity, and a coupon rate of 3% Investors will receive two equal payments from tranche A at end of each year. Tranche B has a face value of $ 30 million, a five- year maturity, and a coupon rate of 7%. Tranche Z has a face value of $60 million, a ten-year maturity, and a coupon rate of 12% Investors of tranche B will only receive coupon payment after tranche A is fully paid. Investors of tranche Z will start to receive payments only after tranche a is fully paid. Interest rate is 5% per year. Please find the residual cash flow at the end of the first year Multiple Choice 3.12 million 2.72 million 1.21 million 0.75 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts