Question: A, Comment on the performance of Drench using the ratios you have calculated. (150-200 words). B, What problems might Drench have if they operate the

A, Comment on the performance of Drench using the ratios you have calculated. (150-200 words).

B, What problems might Drench have if they operate the business with very little cash? (150-200 Words).

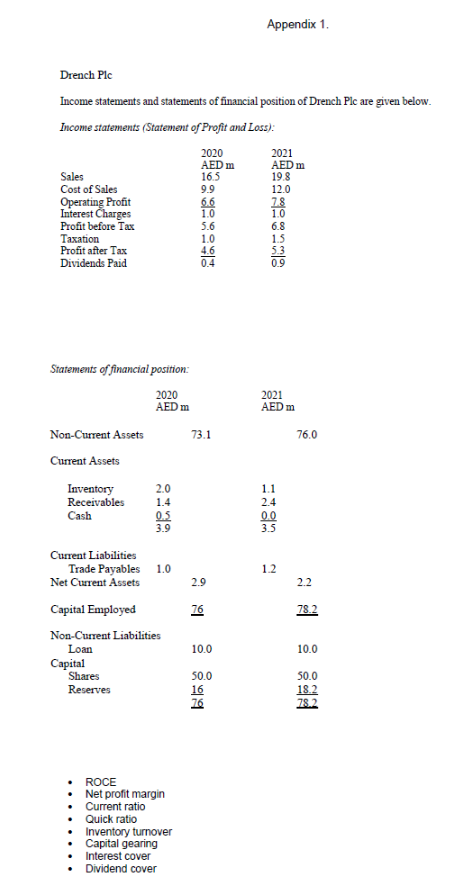

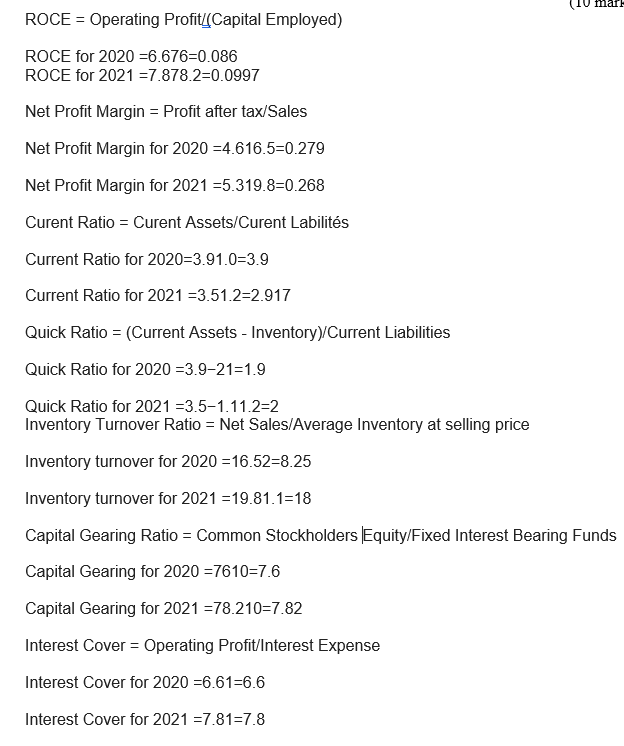

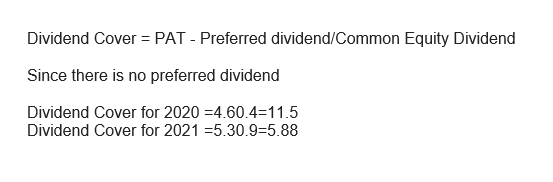

Drench Plc Income statements and statements of financial position of Drench Plc are given below. Income statements (Statement of Profit and Loss): Statements of financial position: - ROCE - Net profit margin - Current ratio - Quick ratio - Inventory turnover - Capital gearing - Interest cover - Dividend cover ROCE = Operating Profit/(Capital Employed) ROCE for 2020=6.676=0.086 ROCE for 2021=7.878.2=0.0997 Net Profit Margin = Profit after tax/Sales Net Profit Margin for 2020=4.616.5=0.279 Net Profit Margin for 2021=5.319.8=0.268 Curent Ratio = Curent Assets / Curent Labilits Current Ratio for 2020=391.0=3.9 Current Ratio for 2021=3.51.2=2.917 Quick Ratio =( Current Assets - Inventory )/ Current Liabilities Quick Ratio for 2020=3.921=1.9 Quick Ratio for 2021=35111.2=2 Inventory Turnover Ratio = Net Sales / Average Inventory at selling price Inventory turnover for 2020=16.52=8.25 Inventory turnover for 2021=19.81.1=18 Capital Gearing Ratio = Common Stockholders Equity/Fixed Interest Bearing Fun Capital Gearing for 2020=7610=7.6 Capital Gearing for 2021=78.210=7.82 Interest Cover = Operating Profit/Interest Expense Interest Cover for 2020=6.61=6.6 Interest Cover for 2021=7.81=7.8 Dividend Cover = PAT - Preferred dividend / Common Equity Dividend Since there is no preferred dividend Dividend Cover for 2020=4.60.4=11.5 Dividend Cover for 2021=5.30.9=5.88

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts