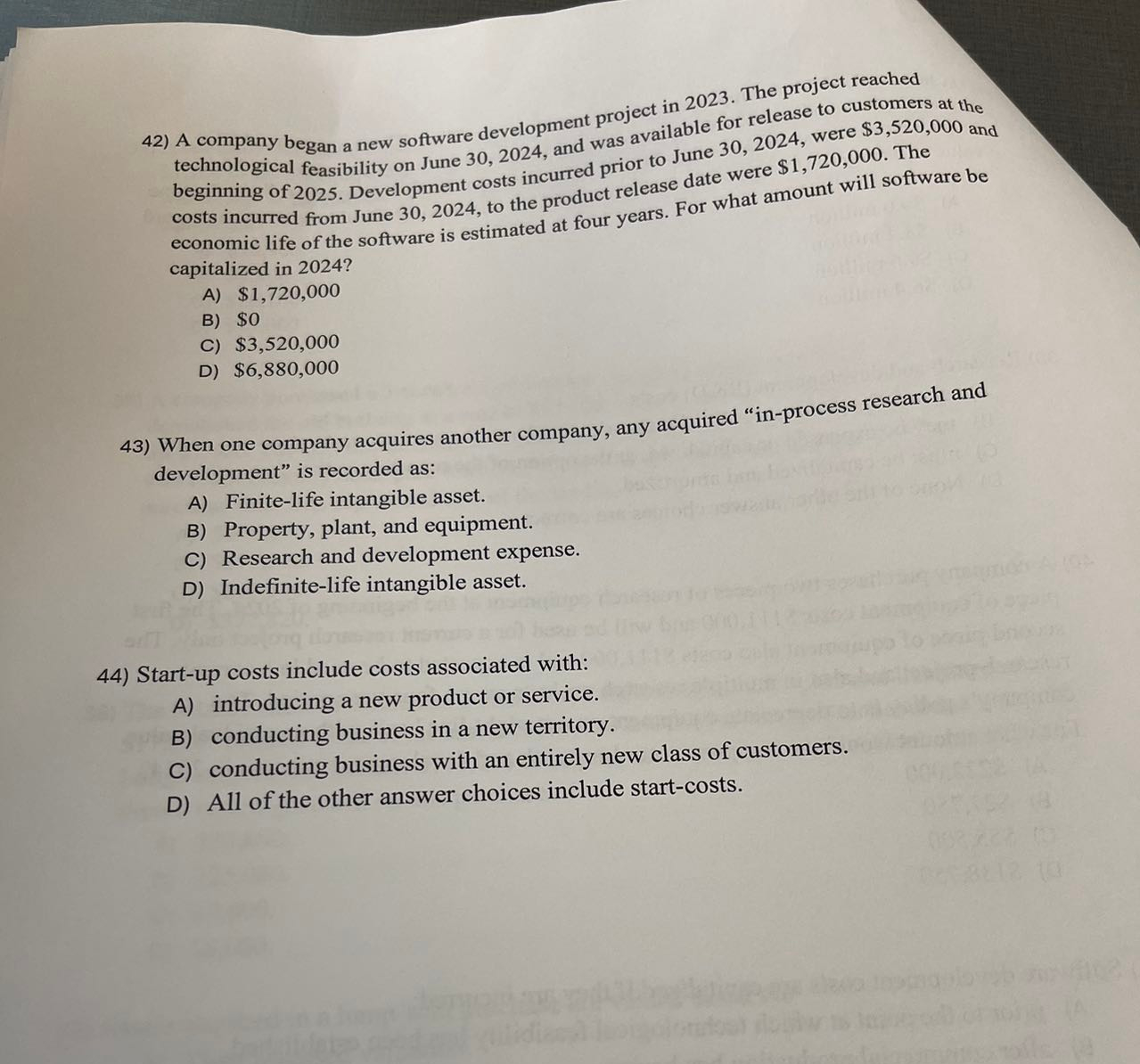

Question: A company began a new software development project in 2 0 2 3 . The project reached technological feasibility on June 3 0 , 2

A company began a new software development project in The project reached

technological feasibility on June and was available for release to customers at the

beginning of Development costs incurred prior to June were $ and

costs incurred from June to the product release date were $ The

economic life of the software is estimated at four years. For what amount will software be

capitalized in

A $

B $

C $

D $

When one company acquires another company, any acquired inprocess research and

development" is recorded as:

A Finitelife intangible asset.

B Property, plant, and equipment.

C Research and development expense.

D Indefinitelife intangible asset.

Startup costs include costs associated with:

A introducing a new product or service.

B conducting business in a new territory.

C conducting business with an entirely new class of customers.

D All of the other answer choices include startcosts.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock