Question: A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as

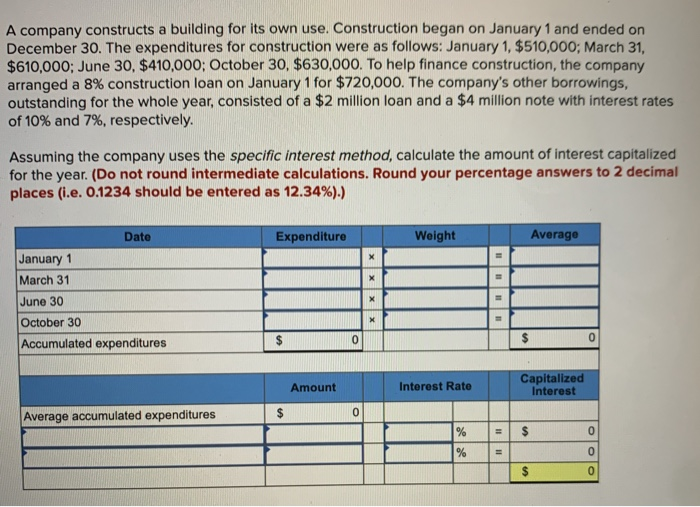

A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as follows: January 1, $510,000; March 31, $610,000; June 30, $410,000; October 30, $630,000. To help finance construction, the company arranged a 8% construction loan on January 1 for $720,000. The company's other borrowings, outstanding for the whole year, consisted of a $2 million loan and a $4 million note with interest rates of 10% and 7%, respectively. Assuming the company uses the specific interest method, calculate the amount of interest capitalized for the year. (Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e. 0.1234 should be entered as 12.34%).) Date Expenditure Weight Average X January 1 March 31 June 30 October 30 Accumulated expenditures X x 0 0 Amount Interest Rate Capitalized Interest $ 0 Average accumulated expenditures % $ 0 % = 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts