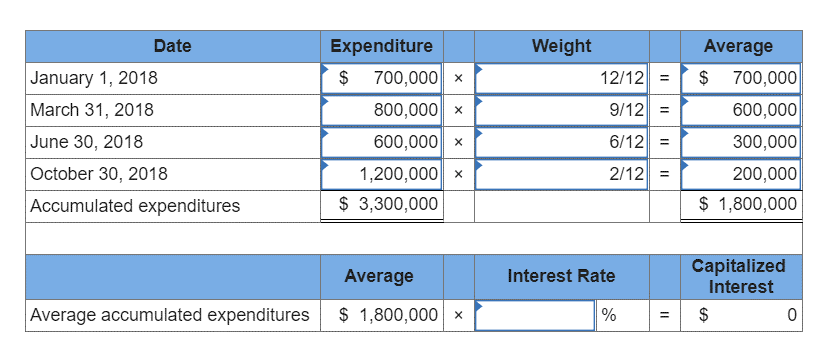

Question: A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as

A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as follows: January 1, $700,000; March 31, $800,000; June 30, $600,000; October 30, $1,200,000. To help finance construction, the company arranged a 8% construction loan on January 1 for $1,100,000. The companys other borrowings, outstanding for the whole year, consisted of a $7 million loan and a $9 million note with interest rates of 10% and 6%, respectively. Assuming the company uses the weighted-average method, calculate the amount of interest capitalized for the year. (Do not round intermediate calculations. Round your percentage answer to 2 decimal places (i.e. 0.1234 should be entered as 12.34%).)

What is the interest rate for the average accumulated expenditures? EXPLAIN PLEASE!

Date Expenditure Weight Average January 1, 2018 March 31, 2018 June 30, 2018 October 30, 2018 Accumulated expenditures 700,0001 800.000x 600.000x 12/12$ 700,000 600,000 300,000 200,000 $1,800,000 2/12l = 1.200.0001 $3,300,000 Capitalized Interest Average Interest Rate Average accumulated expenditures $ 1,800,000x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts