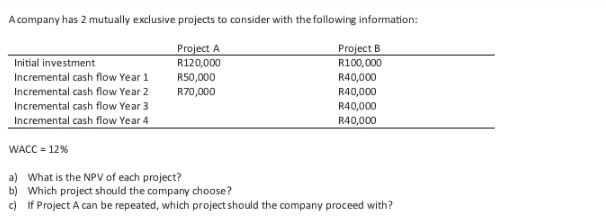

Question: A company has 2 mutually exclusive projects to consider with the following information: Project A R120,000 Project B R100,000 R40,000 Initial investment Incremental cash

A company has 2 mutually exclusive projects to consider with the following information: Project A R120,000 Project B R100,000 R40,000 Initial investment Incremental cash flow Year 1 Incremental cash flow Year 2 Incremental cash flow Year 3 Incremental cash flow Year 4 WACC = 12% a) What is the NPV of each project? b) Which project should the company choose? c) If Project A can be repeated, which project should the company proceed with? R50,000 R70,000 R40,000 R40,000 R40,000

Step by Step Solution

There are 3 Steps involved in it

a To calculate the NPV of each project we need to discount the incremental cash flows by the WACC The NPV of Project A is NPVA R120000 R50000 1 012 R4... View full answer

Get step-by-step solutions from verified subject matter experts