Question: A company has a processing department with 10 stations. Because of the nature and use of three of these stations, each is considered a separate

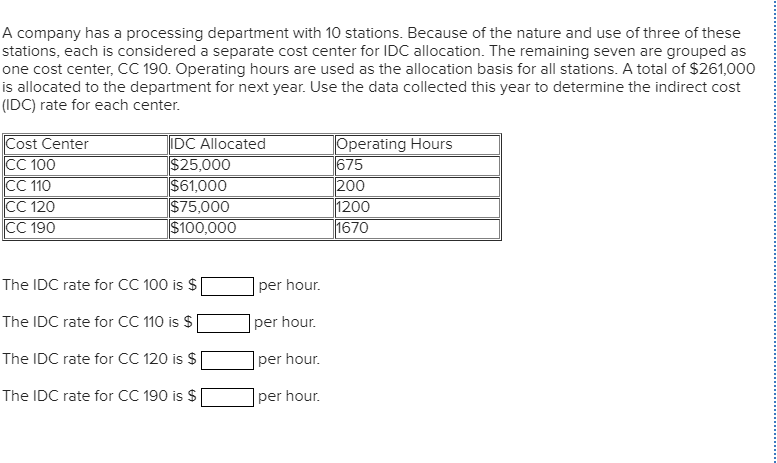

A company has a processing department with 10 stations. Because of the nature and use of three of these stations, each is considered a separate cost center for IDC allocation. The remaining seven are grouped as one cost center, CC 190. Operating hours are used as the allocation basis for all stations. A total of $261,000 is allocated to the department for next year. Use the data collected this year to determine the indirect cost (IDC) rate for each center. ost Center perating Hours DC Allocated $25,000 CC 100 C 110 CC 120 CC 190 61,000 $75,000 $100,000 75 200 1200 1670 The IDC rate for CC 100 is Sper hour. The IDC rate for CC 110 is $ The IDC rate for CC 120 is $ The IDC rate for CC 190 is $ per hour per hour

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts