Question: A company has decided to undertake a certain project. The initial investment for the project is 389 million pesos with a risk free rate

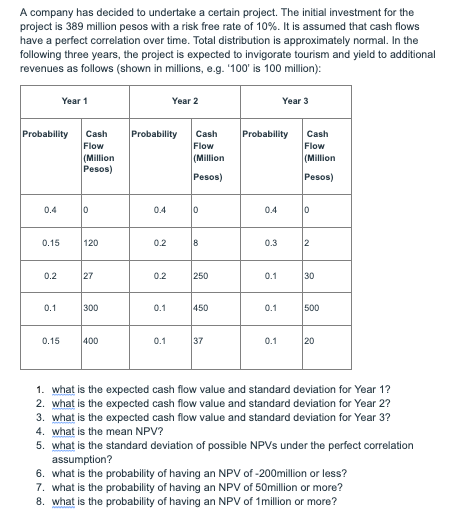

A company has decided to undertake a certain project. The initial investment for the project is 389 million pesos with a risk free rate of 10%. It is assumed that cash flows have a perfect correlation over time. Total distribution is approximately normal. In the following three years, the project is expected to invigorate tourism and yield to additional revenues as follows (shown in millions, e.g. '100' is 100 million): Year 3 Probability Cash Flow 0.4 0.15 0.2 0.1 Year 1 0.15 (Million Pesos) 0 120 27 300 400 Probability Cash Flow (Million Pesos) 0.4 0.2 0.2 0.1 Year 2 0.1 0 8 250 450 37 Probability 0.4 0.3 0.1 0.1 0.1 Cash Flow (Million Pesos) 0 2 30 500 20 1. what is the expected cash flow value and standard deviation for Year 1? 2. what is the expected cash flow value and standard deviation for Year 2? 3. what is the expected cash flow value and standard deviation for Year 3? 4. what is the mean NPV? 5. what is the standard deviation of possible NPVS under the perfect correlation assumption? 6. what is the probability of having an NPV of -200million or less? 7. what is the probability of having an NPV of 50million or more? 8. what is the probability of having an NPV of 1 million or more?

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

1 To find the expected cash flow value for each year we need to multiply each cash flow value by its corresponding probability and sum them up For Yea... View full answer

Get step-by-step solutions from verified subject matter experts